It's an eventful day in the markets and stocks are jumping.

Here are the five things you need to know before the opening bell rings in New York:

1. The ECB delivers: The European Central Bank set the tone Thursday for the markets by cutting interest rates further into negative territory and ramping up its stimulus program.

The ECB cut all three of its main interest rates, including cutting its deposit rate to minus 0.4% from minus 0.3%. It is also increasing the amount of bonds it is buying each month by 20 billion euros ($22 billion), and will begin buying corporate bonds. It was already buying assets worth 60 billion euros ($66 billion) each month.

The moves are meant to combat deflation and get money coursing through the eurozone economy. ECB president Mario Draghi is holding a news conference at 8:30 a.m. ET to discuss the moves.

The euro fell by more than 1% against the dollar in reaction to the announcement, and stocks jumped.

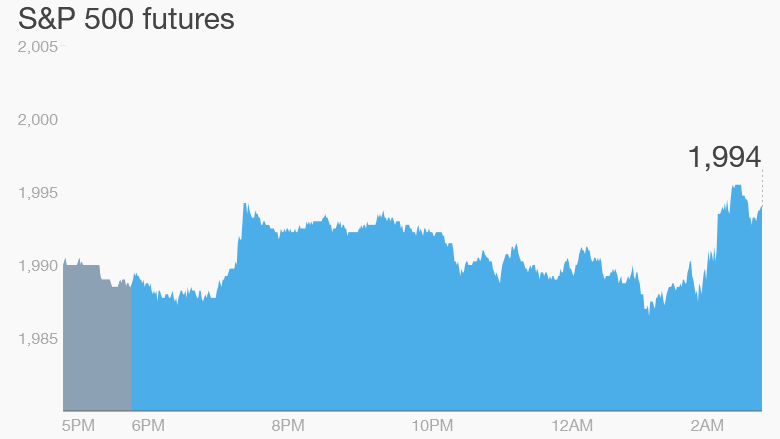

2. Global market overview: U.S. stock futures are shooting up ahead of the opening bell. Most European markets are rallying on the ECB news: Germany's DAX index is up 2.5%.

Yields on 10-year government bonds are sinking in Europe.

In commodities, U.S. crude oil futures are trading just above $38 per barrel. Prices are slipping for precious metals and most industrial metals.

3. Market mover -- Volkswagen: Shares in Volkswagen (VLKAY) are in the red in Germany after the company's top executive in the U.S. stepped down. Volkswagen Group of America said its CEO Michael Horn left his post on Wednesday.

The automaker is mired in a growing scandal over falsified emissions tests.

4. Earnings and economics: Companies including Dollar General (DG), Canadian Solar (CSIQ), Party City (PRTY) and Stein Mart (SMRT) are posting quarterly earnings ahead of the open.

Zumiez (ZUMZ) and El Pollo Loco (LOCO) are reporting after the close.

On the economic front, traders will be watching for U.S. natural gas inventory data at 10:30 a.m. Then the U.S. Treasury Department will release its February budget at 2 p.m.

5. Wednesday market recap: It was a subdued day in the markets on Wednesday, but they still managed to inch higher.

The Dow Jones industrial average climbed 0.2%, the S&P 500 added 0.5% and the Nasdaq ticked up 0.6%.