Gold is glittering like it hasn't in three decades.

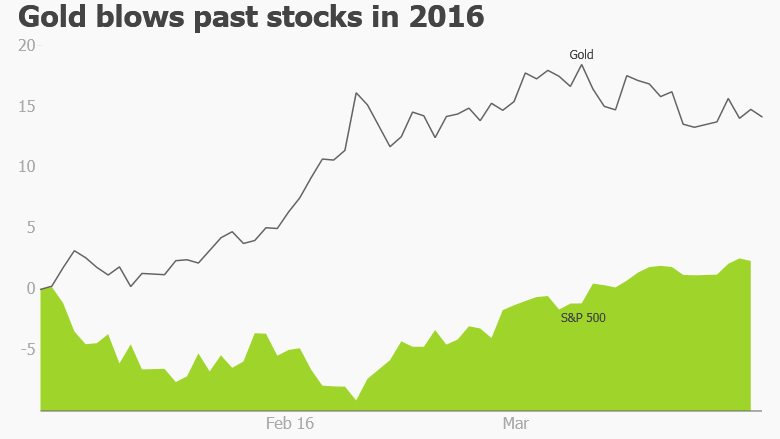

A mixture of early 2016 market turmoil and an erosion of confidence in central banks sent gold spiking 16.5% to $1,234 an ounce in the first quarter. It's the best quarter for the precious metal since 1986.

Gold isn't just on fire. It's crushing virtually every other asset class this year. While U.S. stocks have erased their huge losses, stocks in Europe, the U.K. and Japan are still stuck in the red. Bonds are up mostly, but gold's gains shine the brightest. The popular SPDR Gold Trust ETF (GLD) surged 16%, its best quarter since launching in 2004.

All of this is a reflection of gold's role as the ultimate safe haven that investors turn to when they're scared. And clearly many people were very scared as the Dow got off to its worst start to a year ever, China's economy seemed to be slowing drastically and the crash in oil prices freaked Wall Street out.

"You had the panic trade where when people see volatility they rush to safe assets like gold. There was this perfect storm of events," said Nicholas Colas, chief market strategist at ConvergEx.

Related: Investors are still betting big on gold. What do they know that you don't?

Fear caused investors to pour $13.4 billion into gold assets during a recent 11-week stretch, the largest sustained weekly inflow since the 2009 financial crisis, according to Bank of America Merrill Lynch. Compare that to the final quarter of last year when investors yanked $2.6 billion from gold.

Gold has also benefited from increased skepticism over the waning power of global central banks to juice their economies. Investors are concerned the U.S. Federal Reserve has few tools left to use in a crisis.

There's also a great deal of doubt over central banks' unorthodox tactics, especially the unforeseen consequences linked to negative interest rates launched by the European Central Bank and Bank of Japan. Prominent investor and gold bull Jeff Gundlach recently warned that negative rates are "really bad" and will "backfire like an old Model-T."

The World Gold Council thinks the negative rate trend may result in higher demand for gold because it "erodes confidence" in currencies and increases "uncertainty and market volatility."

Even though gold is looked at as a fear trade, it's still subject to laws of supply and demand. Colas of ConvergEx notes that gold production declined in the fourth quarter for the first time in years and could do so again this quarter.

Related: 92% of investors made money in March after insane 1st quarter

Of course, it's worth pointing out that even after the terrific start to 2016, the price of gold remains a long way from its all-time high of $1,923 set in September 2011.

Not surprisingly, gold's momentum eased considerably after global markets calmed down in mid-February. The yellow metal is actually down 1% since February 11. By comparison, the S&P 500 is up 13% since then, while emerging market stocks have soared 18% and oil has spiked over 40%.

Royal Bank of Canada warns gold bugs an outright decline could be coming next for gold.

"We think gold should consolidate at a lower level than set this quarter, at least in the near-term," RBC wrote in a report.