Donald Trump and Bernie Sanders have said repeatedly that America's unemployment rate is higher than 5%. Now a Wall Street bank agrees with them.

The real rate is "more like 6%+," Bank of America Merrill Lynch said in a research report Tuesday.

Bank of America believes that over 10 million people want a job and can't get one. But by the Obama administration's count, only 8 million people are among those firing off resumes online and showing up at job fairs with no luck.

It's a substantial difference. It means the job market hasn't fully healed, argues Bank of America.

Related: Why doesn't 5% unemployment feel great?

Trump and Sanders have been attacking the official government unemployment figure for months.

"We're not at 5% unemployment. We're at a number that's probably into the twenties if you look at the real number," Trump said last week.

Sanders puts it this way: "Who denies that real unemployment today, including those that have given up looking for work and working part time, is close to 10%?"

Related: Trump's latest wild claim: He'll fix the debt in 8 years

Why Bank of America says 5% is too low

The number crunchers at Bank of America see this as a math issue, not a political one.

The unemployment rate is a simple equation: unemployed/(employed + unemployed)

In order to be counted as unemployed, people have to be actively look for work. But here's the hitch: after the Great Recession, it appears that some people became depressed about their prospects to land a job and gave up. That means that even though they don't have a job, they would no longer be counted as unemployed because they aren't actively searching.

You can see it in the data. Republicans often point to the so-called labor force participation rate, a gauge of how many adults are working or looking for a job. It has dropped from 66.4% at the start of 2007 to 63% now.

There's a lot of debate about what has caused the big fall. Some of it is due to Baby Boomers retiring. But Bank of America says that's not the full story. Some of these people are on the sidelines waiting to search again when they are more confident there are jobs out there for them.

Related: Americans fear a life of 'dead-end crap jobs with crap wages'

"If true, it means the labor market is not yet at full employment, justifying a very slow and cautious [Federal Reserve] hiking cycle," the Bank of America report says.

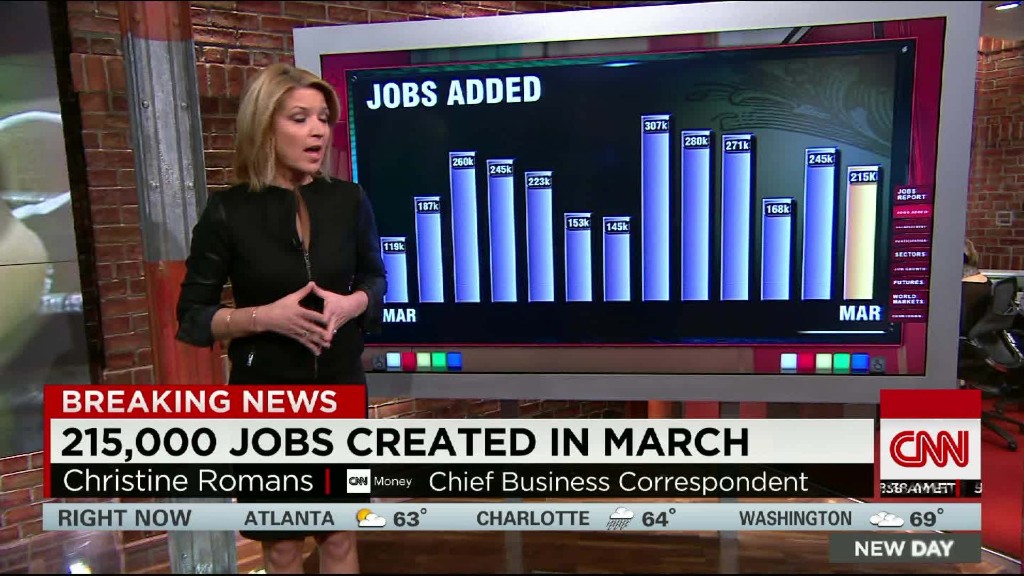

While there is still a ways to go, the U.S. has been making progress. The past two years have been the strongest for hiring in America since 1999. Just last month, the U.S. economy gained 215,000 jobs indicating a healthy labor market.

All of the hiring has actually encouraged some people to start looking for jobs again. The labor force participation rate has been on the rise since September.