Get ready for a big day.

Here are the five things you need to know before the opening bell rings in New York:

1. Massive pharma deal collapses: The $160 billion takeover deal between Pfizer (PFE) and Allergan (AGN) has fallen apart.

The breakup comes after the U.S. Treasury introduced new regulations on Monday designed to deter U.S. companies from merging with foreign firms in order to lower their American tax bill.

Shares in the Dublin-based Allergan dropped sharply Tuesday on expectations the deal would be nixed.

The firms said the acquisition was "terminated by mutual agreement."

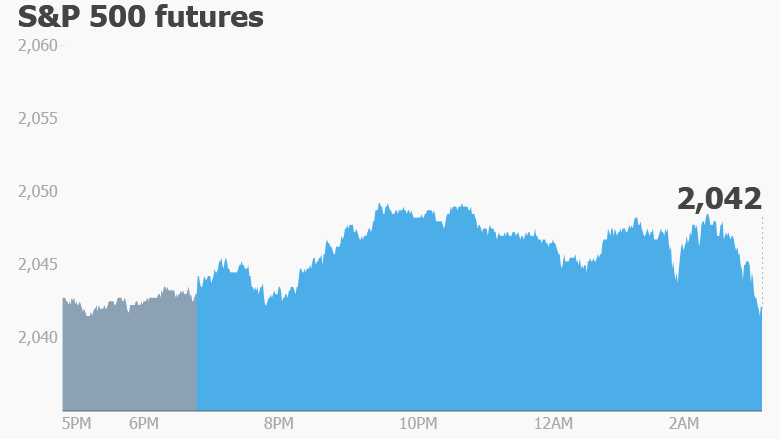

2. Global market overview: U.S. stock futures are pushing up and there's a relatively positive mood in European markets.

Asian markets ended the day with mixed results.

The mood has been helped by a rally in oil prices of about 3% to around $37 per barrel. Traders will get more information about the oil market at 10:30 a.m. ET when the U.S. Energy Information Administration releases its weekly oil inventory report.

One of the biggest market movers of the day is Air France-KLM Group. Shares in the European carrier are down by about 3% after the company announced its CEO was leaving the firm for a new role.

Related: 20 stocks poised to crush earnings season

3. Earnings: A few high-profile earning reports will be coming through Wednesday.

Monsanto (MON) and Constellation Brands (STZ) are reporting results ahead of the open.

Swedish retailer H&M (HNNMY) reported results showing sales rose by about 8.5%, though profit took a hit due to higher costs. Shares in the company are rising by about 4% on the Nasdaq Nordic exchange.

Bed Bath & Beyond (BBBY) will report its quarterly results after the markets close.

4. The view from the Fed: The U.S. Federal Reserve will release the minutes from its latest meeting on monetary policy at 2 p.m. ET. Traders like to mine this release for insight into the Fed's views on the economy and its plans for interest rate levels.

The Fed began raising interest rates in December from record-low levels. But there is uncertainty about how quickly it will hike rates in the future.

Related: Has the Federal Reserve messed up?

5. Tuesday market recap: Tuesday was a negative day for U.S. stocks.

The Dow Jones industrial average declined by 0.8%, while the S&P 500 and the Nasdaq each fell by 1%.