Welcome to a new week.

Here are the five things you need to know before the opening bell rings in New York:

1. Biggest deal of the year: German drugs and chemicals group Bayer (BAYRY) said it's willing to pay $62 billion in cash for U.S. seeds giant Monsanto (MON). That would be the biggest takeover of the year so far if it happens.

Monsanto, (MON) the world's largest seed seller, said last week it had received an unsolicited takeover offer from Bayer, but it gave no financial details.

The $122 per share bid represents a hefty 37% premium over Monsanto's closing price on May 9, before takeover rumors began to circulate.

Shares in Monsanto are surging premarket.

2. Arms to Vietnam?: President Obama announced the U.S. is fully lifting its ban on lethal arms sales to Vietnam. The embargo had been in place for decades. This could help U.S. defense contractors.

Obama said the move was not based on countering China's rise in the region rather on a desire to continue normalizing relations between the U.S. and Vietnam.

Meanwhile, Boeing (BA) is celebrating an $11.3 billion deal to sell 100 737s to airline VietJet. Obama watched as the deal was signed.

3. Economics: Fresh evidence of Brazil's deep recession will emerge on Monday when the country releases its April jobs report. Brazil is expected to post job losses for the 13th month in a row.

Brazil's unemployment rate shot up to 10.2% earlier this year, which is the same level the U.S. jobless rate hit around the Great Recession in 2009.

Talking of recession, the British government has warned of a year-long economic slump if voters choose to leave the European Union in a referendum in June.

Information about the state of American manufacturing industry is due on Monday at 9:45 a.m. ET. The new U.S. Markit manufacturing PMI report for May is expected to show a slight improvement compared to the previous month.

Related: Rio Olympics won't save Brazil

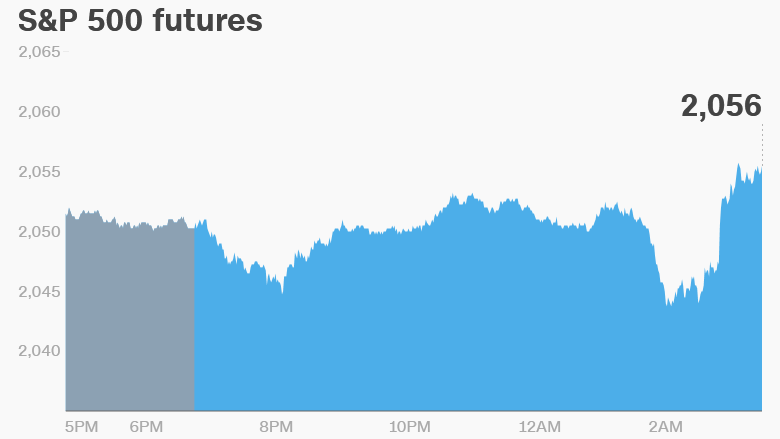

4. Global market overview: U.S. stock futures are pointing up and European markets are edging higher in early trading.

Asian markets ended the day with mixed results.

Crude oil futures are slipping by about 1% to trade around $48 per barrel.

Last week it had looked like oil would power past the $50 mark due to unexpected supply outages.

5. Weekly market recap: There was no clear upward or downward trend in the market last week.

The Dow Jones industrial average sank 0.2% over the course of five trading days while the S&P 500 rose 0.3% and the Nasdaq rose 1.1%.