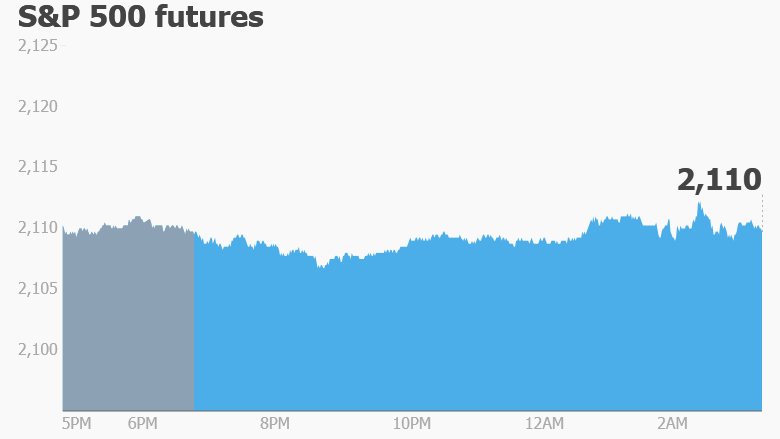

The S&P 500 index has gone 42 days without a big sell-off. Will this be the 43rd?

Markets in Europe are softer but U.S. stock futures are mostly flat. Here are the four things you need to know before the opening bell rings in New York:

1. China trade: Data from China gave investors reason to believe the world's second biggest economy may be on the mend. Trade did slow down in May, but the numbers were stronger than last month and the country's imports rose in yuan terms for the first time since 2014.

"Whilst we may be seeing a contraction, it is at a slower pace and could indicate that the country is seeing some stabilization," Ana Thaker, economist at PhillipCapital UK, wrote in a note.

2. Stock market movers -- Gevo, Samsung SDI, Panasonic: Penny stock Gevo (GEVO) is soaring premarket after gaining 77% in the last five days. The Colorado-based company said the first two commercial flights using its renewable alcohol-based jet fuel took place on Tuesday.

Related: Stocks haven't had a dive in 41 days

Shares in Samsung SDI rose late Tuesday after reports said the company was in talks with Tesla (TSLA) to supply batteries for its new mass market Model 3. But the stock plunged 8% Wednesday after Elon Musk tweeted that Tesla was working exclusively with Panasonic (PCRFF) for Model 3 cells. Panasonic shares rose 3.6%.

3. Earnings and economics: Lululemon Athletica (LULU) is reporting ahead of the open. The yoga apparel maker is having a pretty good year, with the stock is up nearly 30%.

Comtech Telecomunication (CMTL), Oil-Dri Corporation of America (ODC) and ABM Industries (ABM) report after the closing bell.

The U.S. Department of Energy will post its update to U.S. crude inventories at 10:30 a.m. ET. U.S. crude oil futures are trading just above $50 per barrel.

Japan revised its first quarter annualized GDP growth up to 1.9%, from 1.7%. The first reading was stronger than many economists had expected and ensured the country avoided slipping into recession.

The European Central Bank starts its corporate bond buying program on Wednesday, announced as part of its huge stimulus program back in March.

4. Markets overview: European markets are declining in early trading, while Asian markets ended the session mixed. The Dow Jones industrial average and the S&P 500 added 0.1% on Tuesday, while the Nasdaq declined 0.1%.