Phew. What a roller-coaster week.

As Brexit risk has loomed, CNNMoney's Fear & Greed index flipped briefly into "Fear" mode on Thursday. That's a complete reversal from a week ago when the gauge of market sentiment was flashing "Extreme Greed."

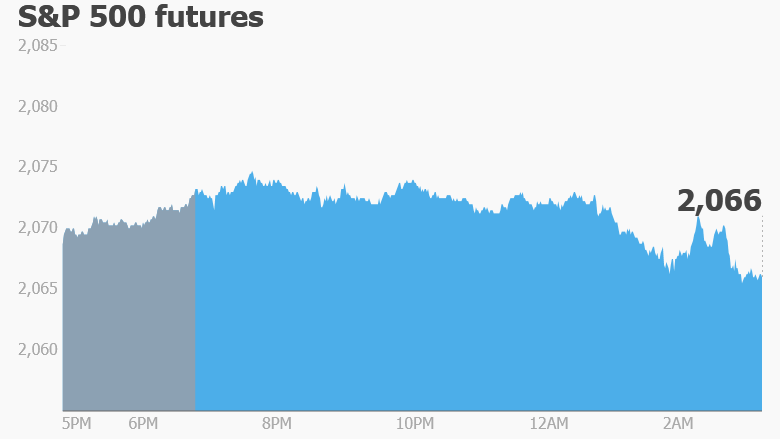

After all that turmoil, U.S. stock futures are flat early Friday.

Here are the five things you need to know before the opening bell rings in New York:

1. Brexit campaigning suspended: The EU referendum debate in the U.K. has been overshadowed by the killing of lawmaker Jo Cox, who was shot and stabbed after meeting constituents in her district in northern England.

Both sides have suspended their campaigns, and the Bank of England governor Mark Carney canceled a speech planned for Thursday night.

Related: Rising Brexit risk slams stocks and pound

Fears over the outcome of the referendum have rattled currency markets recently after a wave of polls suggested the U.K. could vote to leave. The pound fell to a fresh two-month low against the dollar on Thursday, before bouncing back.

2. Stock market movers -- Elizabeth Arden, MGM Resorts International, Smith & Wesson, Oracle: Elizabeth Arden (RDEN) stock jumped 48% in after-hours trading following a deal to be taken over by rival cosmetics maker Revlon (REV).

MGM Resorts International (MGM) was up in post-market trading after announcing cost cutting program and raising a profit goal by $100 million.

Shares in Smith & Wesson (SWHC) spiked nearly 7% in after-hours trading after the gun seller said firearms sales were up 22% year on year.

Oracle (ORCL) stock was up 2% after hours after the company beat analysts expectations on earnings.

3. Economics: The U.S. Census Bureau is set to issue its May Housing Starts and Building Permits reports at 8:30a ET.

Mario Draghi, the president of European Central Bank, will speak at 11 a.m. ET.

4. International markets overview: European markets are all up in early trading. Eurozone finance ministers approved a 7.5 billion euro ($8.4 billion) bailout loan for Greece on Thursday, after completing the first review of the country's economic program.

The loans were agreed last summer, but their disbursement depended on the Greek government meeting the lenders' demands.

Major Asian markets ended the session in positive territory.

5. Thursday market recap: The Dow Jones industrial average went on a wild ride on Thursday, plunging as much as 169 points and then closing 93 points up. The S&P 500 finished 0.3% higher, while the Nasdaq added 0.2%.