China's currency keeps sinking against the dollar.

Since Donald Trump won the U.S. presidential election last week, Beijing has allowed the yuan to tumble. The fall continued Tuesday, with one dollar buying around 6.86 yuan, the weakest the Chinese currency has been since the dark days of the global financial crisis in late 2008.

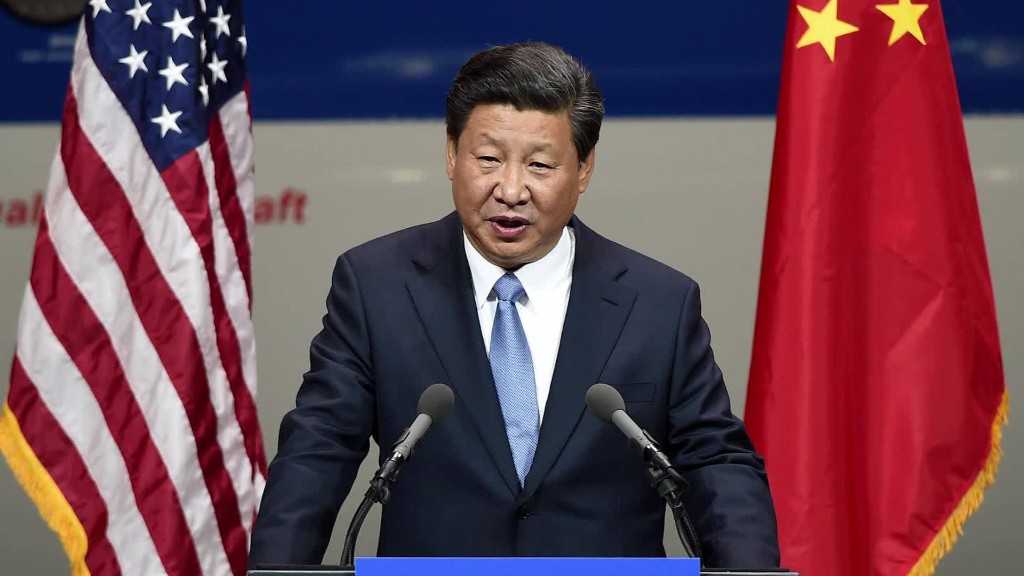

Trump's victory has cast a deep shadow over the relationship between the world's two largest economies. On the campaign trail, he threatened to impose tariffs of as much as 45% on Chinese goods and label Beijing a currency manipulator on his first day in the White House.

Hitting China with the currency manipulator tag is largely a symbolic move, but it could fuel tensions with Beijing and serve as the first step on a path toward introducing real penalties.

Related: Trump win fuels 'violent reaction' in the bond market

The market impact of Trump's win is already creating an immediate headache for the Chinese government. The U.S. dollar has surged against other currencies on expectations of a rate hike by the U.S. Federal Reserve next month and the potential for higher growth and inflation under Trump.

'A fragile position'

Beijing doesn't want the yuan "to follow the dollar up against all these currencies," which makes Chinese exports less competitive, said Julian Evans-Pritchard, a China expert at Capital Economics. "The risk of course is that means letting the currency fall against the dollar. It's quite a fragile position they're in."

If the yuan drops too sharply against the dollar, it could set off a repeat of the market panic in August 2015 and January 2016. It would also swell the flows of money pouring out of China's slowing economy since last year.

More than $540 billion has left China so far this year, nearly 10% higher than during the same period in 2015, according to estimates from the Institute of International Finance. That in turn puts huge downward pressure on the yuan, which is also known as the renminbi.

'Trying to let the pressure out'

"They're trying to let the pressure out slowly," Evans-Pritchard said. "If they don't ... they're going to face a situation like they did in mid-2015, when the renminbi became too strong."

Beijing has burned through hundreds of billions of dollars since last year in efforts to stop the yuan sinking too fast. The country's foreign currency war chest, while still ample, has shrunk to its lowest level in five years.

Related: 3 ways Trump can slap tariffs on China and Mexico

Other analysts warn that expectations of more rate hikes by the Fed are likely to draw even more funds out of China in search of better returns on assets priced in U.S. dollars.

"We are in for the second round of money outflows," said Kevin Lai, China economist at Daiwa Capital Markets. "This round appears to be bigger than the first. And Trump's victory makes it even worse."

-- Serenitie Wang contributed to this report.