1. Janet Yellen in the hot seat: All eyes are on Federal Reserve chief Janet Yellen.

She's making an appearance before Congress Thursday morning to talk about the state of the U.S. economy.

Wall Street is combing through her prepared remarks, which came out at 8 a.m. ET. Traders are looking for more hints that the Federal Reserve chair supports raising interest rates in December. The text shows Yellen will say interest rates could be raised "relatively soon."

Yellen's testimony will start at 10 a.m. She's expected to be asked about President-elect Donald Trump's push for fiscal stimulus, and whether that could allow the Fed to raise rates more aggressively.

2. Global market overview: Investors are getting back into bonds after a stunning sell-off in the wake of the U.S. election.

Trump's promise to unleash massive infrastructure spending and gigantic tax cuts spurred selling across a range of government bonds around the world.

The yield on 10-year Treasury notes is dipping to 2.2% this morning. Yields had surged to nearly 2.4% at the start of the week, up from about 1.8% before the election.

Stock market trading is relatively muted right now.

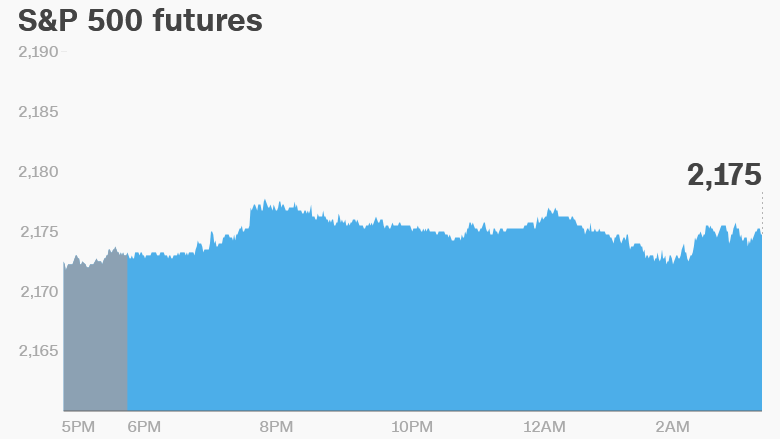

U.S. stock futures are not making any major moves ahead of the open.

European markets are mixed in early trading. Asian markets ended the day with minor gains and losses, but nothing dramatic.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. What to watch -- Solar stocks and banks: Shares in First Solar (FSLR) aren't shining right now. The company announced plans to cut 1,600 jobs, which is equivalent to 27% of its global workforce. The stock is down about 10% premarket.

Traders are also monitoring Tesla Motors (TSLA) and Solar City (SCTY). Tesla's controversial takeover of struggling Solar City could get approved or rejected on Thursday. Shareholders from both companies are voting on the proposed deal during separate meetings.

Federal prosecutors are expected to issue a fine Thursday against JPMorgan (JPM) following an investigation into the company's hiring practices in China. The bank has reportedly been accused of improperly hiring the children of China's ruling elite in an effort to win lucrative business in the country.

Wells Fargo (WFC) is also in the spotlight as the bank is set to release customer numbers for October and host a conference call with its chief financial officer and the head of its retail banking unit.

Wells Fargo admitted in September to creating as many as 2 million fake bank accounts and firing 5,300 of its workers in relation to the scandal.

4. Earnings and economics: Best Buy (BBY), Staples (SPLS) and Walmart (WMT) are some of the key companies reporting earnings before the opening bell.

Investors will be looking for details about how consumer spending held up during the election. They'll also expect forecasts for the holiday shopping season.

Salesforce.com (CRM), Gap (GPS) and Williams-Sonoma (WSM) are releasing earnings after the close.

The U.S. Bureau of Labor Statistics is releasing inflation data for October at 8:30 a.m. The Census Bureau will release reports on housing starts and building permits at the same time.

5. U.S. dollar in focus: The U.S. dollar hit a 13-year high on Wednesday but now it's dipping back down a bit.

The ICE Dollar Index hit 100.57 yesterday. The index tracks the dollar's value versus the world's most traded currencies.

The greenback has been driven up by investors' hopes that the Federal Reserve may raise interest rates more quickly under a Trump presidency.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Thursday - Walmart (WMT) and Salesforce.com (CRM) earnings; Janet Yellen testifies about economic outlook

Friday - "Fantastic Beasts and Where to Find Them" release, "The Grand Tour" premieres on Amazon Prime