1. Senate hearing on AT&T-Time Warner deal: The CEOs of AT&T (T) and Time Warner (TWX) are set to defend their $85 billion mega-merger at a congressional hearing scheduled for 10 a.m. ET.

The CEOs might also eventually face questions from President-elect Donald Trump, who has said the media merger would concentrate "power in the hands of too few."

Time Warner is the parent company of CNNMoney.

2. Italy in wait-and-see mode: Investors are waiting to see if a top Italian bank -- Monte dei Paschi di Siena (BMDPF) -- is going to be able to sort out its own finances or be forced to seek a state bailout.

An announcement could come as early as Wednesday.

The bank is trying to salvage a rescue plan that would see private investors inject €5 billion ($5.4 billion) into the bank. A government bailout is the last resort option, and would cause big losses for shareholders and some bondholders.

Kathleen Brooks, research director at City Index, said the markets are taking the view that "no news is good news."

The bank's volatile shares jumped by roughly 10% on Wednesday. But they're still down by more than 80% since the start of 2016. Other European banking stocks are also rallying.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Starbucks investor day: Starbucks (SBUX) is hosting an event for investors on Wednesday, less than a week after Howard Schultz announced plans to step down as CEO next year.

While the New York event was planned before Schultz's announcement, his departure will likely dominate the day's conversation.

4. India's rate decision: India's central bank announced Wednesday it's leaving interest rates unchanged at 6.25%.

This comes just weeks after the country's shocking decision to scrap its two largest rupee bills. The decision caused about 86% of India's bank notes to become worthless overnight and has drained millions of dollars worth of cash from the economy.

The central bank said it expects slower growth as a result of the cash crunch.

5. Earnings and economics: Costco (COST), H&R Block (HRB) and Lululemon (LULU) are set to release earnings after the close Wednesday.

And the U.S. Energy Information Administration is reporting weekly crude oil inventory data at 10:30 a.m. Oil prices are currently holding steady at around $51 per barrel.

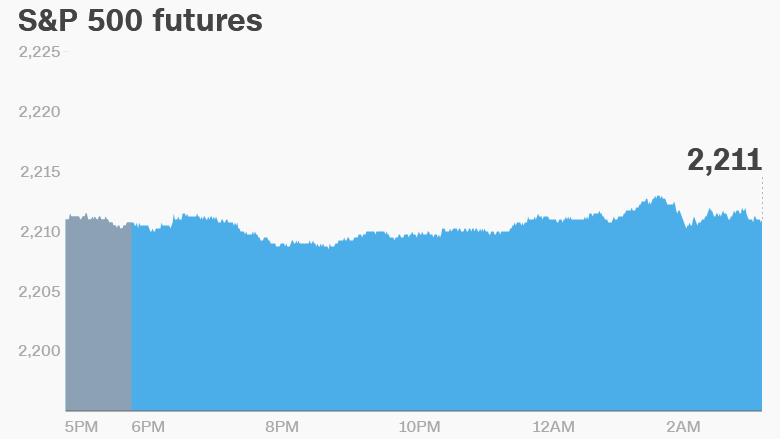

6. Global market overview: U.S. stock futures are holding steady as most global markets power higher.

European markets are making strong gains in early trading.

Asian markets ended the day in positive territory.

Australia's main index also rose 0.9% even as new data showed the economy contracted in the latest quarter, marking the first time the economy shrunk since 2011.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Wednesday - Senate hearing on AT&T-Time Warner merger; GSA weighs in on Trump's hotel lease; Starbucks Investor Day

Thursday - European Central Bank's monetary policy meeting

Friday - Government spending measure expires