1. Trump rally powers on: The Dow has climbed a stunning 1,200 points in the month since Donald Trump's election victory. The index is now within striking distance -- roughly 500 points -- from the 20,000 point milestone.

Investors are hoping that Trump will boost business and help accelerate the U.S. economy with a fiscal stimulus program.

Transport, financial and infrastructure stocks are the biggest winners of the rally.

2. Super Mario strikes again: The European Central Bank announced Thursday it will extend its bond buying program until December 2017.

That's much longer than investors had anticipated. But the bank also said it will decrease the scale of its bond purchases from €80 billion ($86 billion) a month to €60 billion ($64 billion) a month starting in April.

The euro initially gained against the dollar, but quickly reversed course.

Related: Dow zooms over 1,200 points since Trump victory

3. Russia selling Rosneft: Russia is selling off an $11 billion stake in state oil giant Rosneft to Qatar and the Anglo-Swiss miner Glencore (GLCNF). The consortium is buying 19.5% stake in the company, while Russia will retain a controlling stake.

BP (BP) also owns a minority stake in Rosneft.

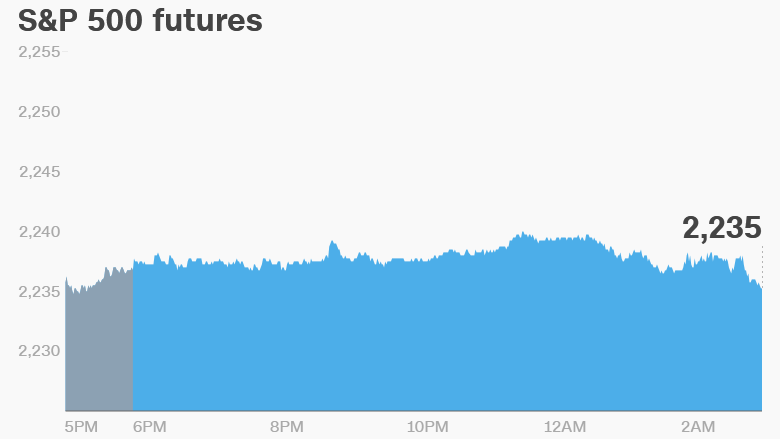

4. Global market overview: Global stock markets are mostly higher on Thursday, following another record breaking session in the U.S. on Wednesday.

Asian markets closed higher. Japan's Nikkei climbed 1.5% and while Korea's Kospi added nearly 2%. European markets are mixed in early trading.

U.S. stock futures are flat.

Both the Dow Jones industrial average and the S&P 500 closed at record highs on Wednesday. The Dow increased 1.6%, while the S&P climbed 1.3% and the Nasdaq added 1.1%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: Sears Holdings (SHLD) will release its earnings before the open Thursday.

The Department of Labor will publish the latest weekly jobless claims report at 8:30 a.m. ET.

China reported stronger than expected trade numbers for November. Exports grew 0.1% year on year in dollar terms, following a 7.5% decline in October.

Japanese third quarter GDP was revised lower to annualized 1.3% on Thursday.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Thursday - European Central Bank's monetary policy meeting

Friday - Government spending measure expires