1. All about the banks: It's a hectic day in the banking sector.

Italian bank Monte dei Paschi (BMDPF) is working on a government bailout that is expected to be worth billions. Trading in the bank's shares has been halted.

Meanwhile, Deutsche Bank (DB) and Credit Suisse (CS) have just announced deals with the U.S. government worth a total of $12.5 billion to settle claims over their roles in the U.S. mortgage meltdown of 2007 and 2008.

Deutsche Bank's deal is worth $7.2 billion while Credit Suisse said its tentative settlement is worth $5.3 billion.

Additionally, a federal lawsuit was launched Thursday accusing British bank Barclays (BCS) of defrauding investors who bought mortgage securities ahead of the financial crisis.

Shares in Deutsche Bank are rising by about 2% as investors show they're relieved the settlement costs weren't higher. Credit Suisse shares had risen earlier in the day, but are now down 1%.

Barclays shares are dipping by 1% in London.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Potential market mover -- Lockheed Martin: Shares in Lockheed Martin (LMT) are dipping in extended trading after President-elect Donald Trump picked a fight with the company in a tweet on Thursday,

Trump said the Pentagon's costly new F-35 Joint Strike Fighter, made by Lockheed Martin (LMT), could be replaced with a modified version of a less expensive plane, the F/A-18 Super Hornet, which is made by aerospace rival Boeing (BA).

3. Dow eyes 20,000 record: The Dow Jones industrial average has been trading just below the 20,000 level for the past two weeks. Based on premarket moves, it looks like that trend will continue Friday.

The Dow has never hit the 20,000 level before. It's currently sitting at 19,919.

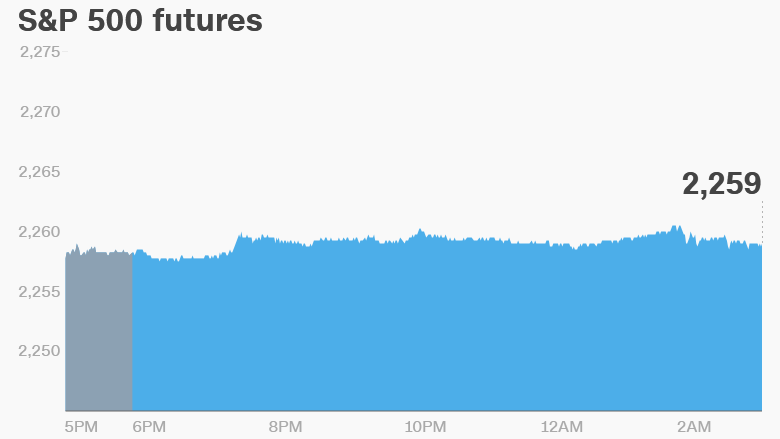

U.S. stock futures are holding steady after stocks slid a bit on Thursday.

European markets are mixed in early trading. Asian markets are mostly ending the week in negative territory.

Download CNN MoneyStream for up-to-the-minute market data and news

4. Economics: The University of Michigan's consumer sentiment index for December is due out at 10 a.m. ET.

Consumer spending is the juggernaut that powers the U.S. economy, so it's important that American consumers are feeling confident and happy.

Also at 10 a.m., the Census Bureau is set to release its November new home sales report.

5. Coming this week:

Friday - Final full trading day before the Christmas long weekend