1. The final Obama jobs report: The Department of Labor released its highly anticipated jobs report on Friday showing the U.S. economy added 156,000 jobs in December, which was slightly below expectations.

This is the final jobs report to be released while President Obama is still in office.

Economists had predicted that America would add 172,000 jobs in December.

The unemployment rate also ticked up a bit to 4.7% from 4.6% in November.

"With the U.S. at full employment, there may be problems finding workers to fill some vacant positions, so a lower [jobs] figure could be a sign of a stronger labor market, not a weaker labor market," warned Paul Donovan, global chief economist at UBS Wealth Management.

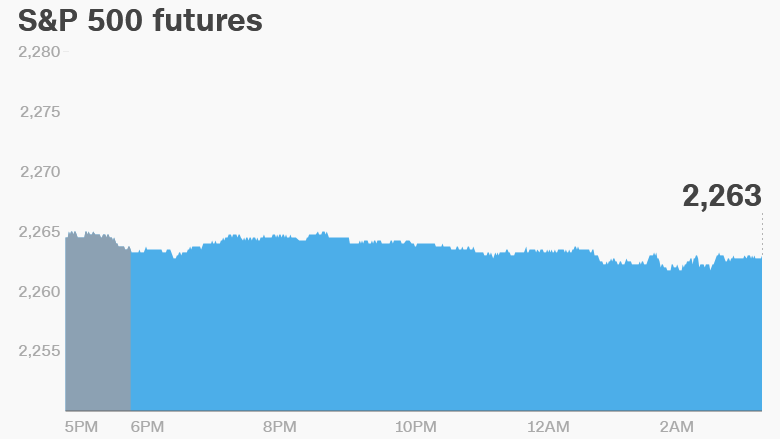

2. Stock market overview: U.S. stock futures are edging up after the jobs report.

European markets are mostly declining in afternoon trading, though the dips are small.

Asian markets ended the week with mixed results.

On Thursday, the Dow Jones industrial average and S&P 500 both edged a bit lower, but the Nasdaq inched up to close at a record 5,488 points.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Market movers -- Toyota, Amgen: Shares in Toyota (TM) slipped by nearly 2% in Tokyo after the company was targeted by a threatening tweet from President-elect Donald Trump.

Trump took aim at the automaker over its plans to open a new factory in Mexico.

"Build plant in U.S. or pay big border tax," he wrote.

Shares in the biopharmaceutical firm Amgen (AMGN) are rallying premarket after a U.S. District Court judge ordered its competitors Sanofi (SNY) and Regeneron Pharmaceuticals (REGN) to stop selling a drug that infringes on Amgen patents.

Sanofi shares are sliding in Europe while trading in Regeneron stock has been suspended.

Both Sanofi and Regeneron say they'll appeal the decision.

4. Eye on India: The Indian government has downgraded its economic growth forecast for the current financial year, expecting the economy to expand by 7.1% instead of 7.6%.

This is the first forecast the government has published since creating a cash crisis by banning 86% of the country's rupee notes.

Analysts estimate the ban could bring down India's strong economic growth by as much as one percentage point.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Friday - Release of U.S. jobs report for December