1. Moody markets: Traders around the world are taking a step back to consider what the future holds with president-elect Donald Trump leading the United States.

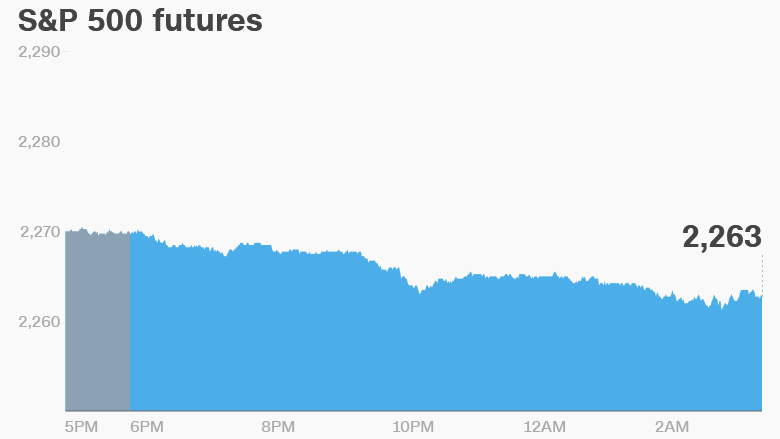

U.S. stock futures are pointing down and the dollar is weakening.

"Investors have been inclined to downplay the risk of candidate Trump's trade protectionism being implemented by the new administration," said Paul Donovan, global chief economist at UBS Wealth Management. "That view may need to be revised in view of the style of [his Wednesday] press conference."

European markets are all declining in early trading. Most Asian markets ended the day with modest losses.

Despite the negative sentiment, many global stock markets are near record highs after getting a post-election 'Trump bump'. The Dow Jones industrial average continues to trade just below the 20,000 point level.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Pharma falls: Shares in pharmaceutical companies continue to drop Thursday as investors worry about Trump's impact on the sector's profitability.

Trump said Wednesday that many pharma companies were "getting away with murder" and that there would be more competitive bidding practices for federal contracts in his administration.

Shire (SHPG) is among the hardest hit stocks right now, down about 4%.

3. Earnings and economics: Delta Air Lines (DAL) is the key company releasing earnings before the open Thursday.

It's expected to detail how it's dealing with higher fuel and labor expenses. Shares have been trading near all-time highs in recent days.

On the economic front, the U.S. Department of Labor is set to release the latest data on weekly unemployment claims at 8:30 a.m. ET.

The U.S. Treasury Department is releasing its December budget at 2 p.m.

A number of U.S. Federal Reserve officials are scheduled to speak on Thursday.

Fed chief Janet Yellen is holding a 7 p.m. town hall event with teachers.

4. UniCredit in the spotlight: Shares in Italy's biggest bank -- UniCredit (UNCFF) -- are weakening on Thursday as the firm said it's writing off €8.1 billion ($8.6 billion) in bad loans.

Shareholders are also set to vote on its plans to raise €13 billion ($13.8 billion) to shore up its finances.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Thursday - Delta (DAL) earnings

Friday - Bank of America (BAC), JPMorgan Chase (JPM) and Wells Fargo (WFC) report earnings