Federal law requires public companies like Wells Fargo to warn shareholders about non-routine legal proceedings.

Yet it has now emerged that Wells Fargo stayed silent for at least six months about the fact that authorities were investigating the bank's creation of fake accounts.

Wells Fargo (WFC) confirmed on Thursday that it was in talks with the Consumer Financial Protection Bureau about unauthorized accounts as early as March 2016. This comes after the Charlotte Observer obtained emails under the Freedom of Information Act that revealed the discussions between the bank and the regulator.

The revelations will intensify questions over why Wells Fargo never alerted investors in public statements or public filings about the risk posed by what turned out to be a damaging investigation.

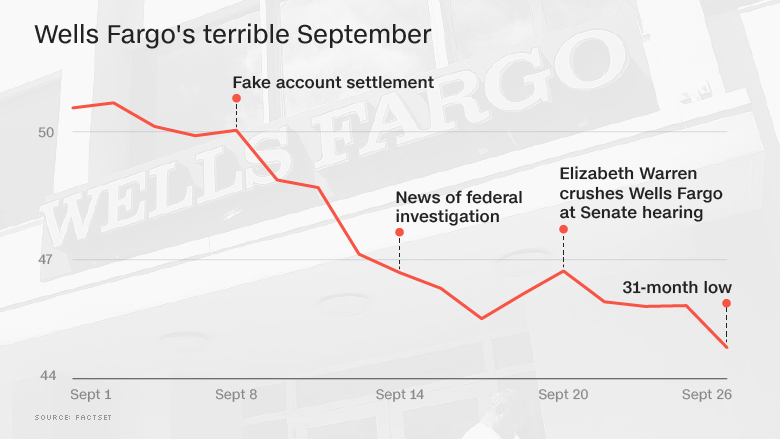

Wells Fargo's September settlement with the CFPB and other regulators tarnished the storied bank's reputation, hurt its stock price, led to the sudden retirement of CEO John Stumpf and included $185 million in fines.

Yet just weeks before the settlement, Wells Fargo filed an SEC document that did not mention the looming settlement or "sales practices" at all. That filing, known as a "10-Q," requires public companies to disclose to shareholders relevant information about their businesses.

Related: GOP: Trump should fire CFPB director

Specifically, securities law says public companies have to describe "any material pending legal proceedings, other than ordinary routine litigation incidental to the business." That includes proceedings "known to be contemplated by government authorities."

Of course, the key word is "material," which makes disclosure more of a judgment call.

Stumpf was quizzed by lawmakers in Congress about why Wells Fargo didn't disclose the matter earlier.

"$185 million was not deemed material," the CEO said at the U.S. Senate's hearing into the fake account scandal.

That response left Senator Pat Toomey incredulous. He pointed to Wells Fargo's stock price, which dropped 11% in the three weeks after the settlement.

"I don't know how this could not be deemed material," Toomey said. "The reputational damage done to the bank clearly is material."

CtW Investment Group, a shareholder activist group representing labor unions, questioned why Wells Fargo didn't tell investors before the settlement.

"The failure to disclose to shareholders in a much timelier way that the investigation was ongoing is troubling," said Rich Clayton, director of research at CtW, which owns about 12 million Wells Fargo shares.

Related: Wells Fargo's notorious sales goals get a makeover

In a statement, Wells Fargo said that each quarter it considers "all available relevant and appropriate facts and circumstances in determining whether a matter is material and should be disclosed."

The SEC declined to comment on whether it's looking into Wells Fargo's disclosure practices.

However, Wells Fargo revealed in November that the SEC is investigating the bank, though it's not clear precisely what the agency is looking into.

Senator Elizabeth Warren wrote a letter to the SEC in late September asking the SEC to investigate Wells Fargo for a number of reasons, including whether the bank committed securities fraud by failing to disclose problems with fake accounts.

Warren also asked the SEC to probe whether Wells Fargo violated whistleblower protection laws. She cited a CNNMoney investigation on Wells Fargo employees who were fired after calling the bank's ethics hotline.