1. Dow streak ends: The Dow Jones industrial average declined on Tuesday.

That's not normally huge news. But this particular decline stopped the index's historic streak of consecutive record closes as 12.

Investors shouldn't despair, however: The Dow has risen by an incredible 2,500 points since the U.S. presidential election.

The Dow shed 0.1% on Tuesday, while the S&P 500 lost 0.3% and the Nasdaq dropped 0.6%.

2. Fed as spoiler: It was chatter from central bank officials that appears to have spoiled the fun.

William Dudley, president of the Federal Reserve Bank of New York, told CNNMoney's Richard Quest on Tuesday that the case for monetary policy tightening has become a "lot more compelling."

Dudley said that interest rates could be raised in the "relatively near future." Other Fed officials have offered similar hints about a potential rate hike.

Fed leaders next meet March 14-15 and most predicted in December that they'll raise rates about three times in 2017.

3. Trump's big speech: President Trump delivered his first speech to Congress on Tuesday, striking a more statesman-like tone. Still, there was little detail on policy.

"A politically interesting, but economically dull speech," said Kathleen Brooks, research director at City Index Direct.

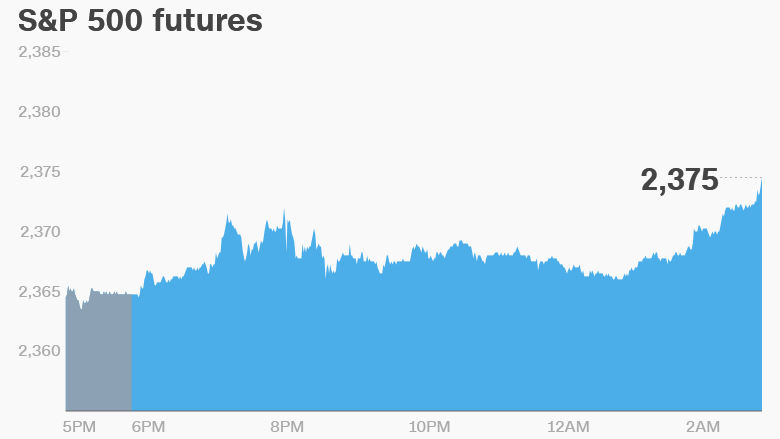

U.S. stock futures were higher on Wednesday morning.

"He offered just enough to keep bulls happy," Accendo Markets analysts wrote in a note to clients.

4. Global market overview: European markets were all around 1% higher in early trading. Most Asian markets ended the session with gains.

Japan's Nikkei advanced almost 1.5% as the yen weakened.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: Best Buy (BBY) and Dollar Tree (DLTR) will release earnings before the open Wednesday, while Monster Beverage (MNST), Planet Fitness (PLNT) and Shake Shack (SHAK) are set to publish results after the close.

U.S. manufacturing data from the ISM survey will be published at 10 a.m. ET.

China's manufacturing purchasing managers index came out above expectations, indicating the country's economy remains on steady path.

Elsewhere, German inflation data for February is expected at 8 a.m. ET and bank of Canada will make an interest rates decision at 10 a.m. ET.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Wednesday - Auto firms report February sales numbers

Thursday - Snapchat parent company Snap set for stock market debut

Friday - Nintendo Switch releases worldwide