1. Bull market birthday: America's bull market turns eight years old on Thursday.

The S&P 500 has shot up an incredible 250% since March 2009. But it would have to charge ahead for another four years to match the length of the longest bull market in history, which ran between 1987 and 2000.

Investors aren't in much of a celebratory mood on Thursday.

"The phenomenal stock market rally has displayed some signs of exhaustion this week with investors on high alert ahead of the looming European Central Bank meeting and [U.S. jobs report] this Friday," said Lukman Otunuga, a research analyst at FXTM.

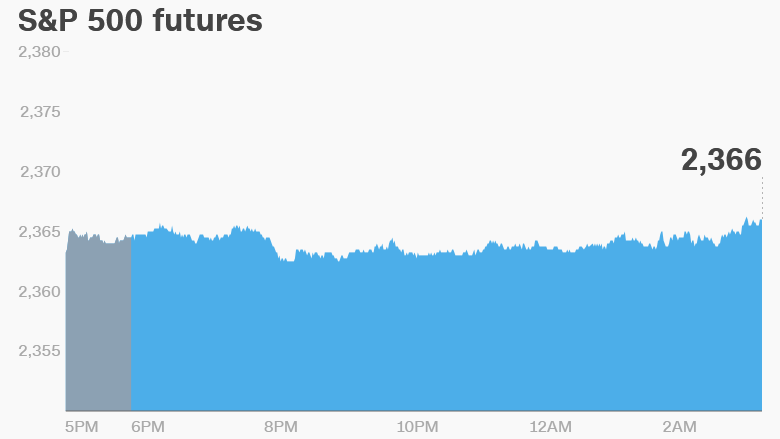

U.S. stock futures were holding steady following three consecutive days of declines.

European markets were mixed in early trading. Most Asian markets ended the day with losses.

2. Watching Europe's central bank: The European Central Bank will issue a decision on interest rates at 7:45 a.m. ET, but no major policy changes are expected.

Investors will be looking for clues about future policy when ECB president Mario Draghi holds a press conference at 8:30 a.m. ET.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Slippery oil: Crude oil futures were off roughly 2% on Thursday as the market reacted to a report released Wednesday that showed a large increase in U.S. crude inventories.

Crude is currently trading around $49 per barrel, down about 10% from a recent peak in February.

4. Market movers -- Tailored Brands, Toshiba: Dismal earnings from the parent company of Men's Wearhouse are scaring the pants off investors. Tailored Brands (TLRD) shares plummeted as much as 27% after hours after the firm posted fourth quarter results.

Like many brick-and-mortar retailers, Tailored Brands has been hit by online shopping and declining foot traffic at malls.

Shares in Toshiba (TOSYY) dropped by 7.2% Thursday following reports that its nuclear business unit is considering filing for bankruptcy. The Japanese company reported a $6.3 billion writedown last month because of unexpected losses at the troubled business.

5. Earning: Signet Jewelers (SIG) and Staples (SPLS) are set to release earnings before the open Thursday.

Signet, which owns the Kay and Jared jewelry chains, was rocked last week by allegations of rampant sexual harassment and discrimination against female employees.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Thursday - Geneva International Motor Show officially begins

Friday - Monthly U.S. jobs report released