1. End of a losing streak?: Investors are feeling a lot calmer right now following a big bout of Trump-inspired volatility.

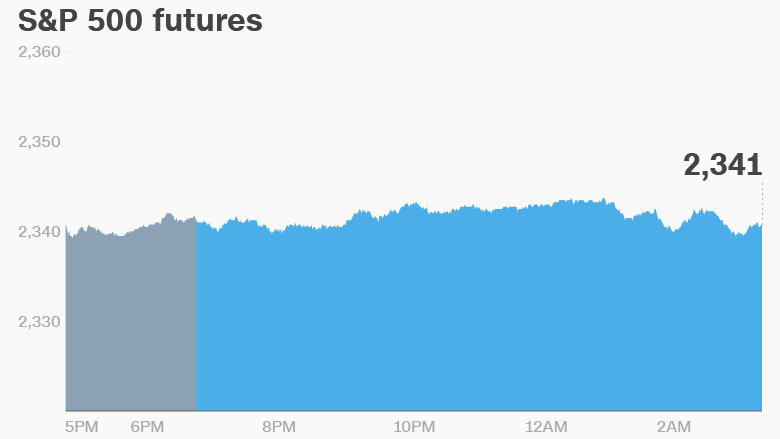

U.S. stock futures are holding steady, and European markets are mostly edging up in early trading. Most Asian markets ended the day with modest gains.

The Nikkei in Japan was a standout performer, closing with a 1.1% boost.

This comes after the Dow Jones industrial average fell for its eighth day in a row on Monday, its longest slump since 2011. The S&P 500 was also down 0.1% on Monday. But the Nasdaq was up 0.2%.

It's worth keeping in mind that U.S. stocks are not far off their highest levels ever, which were hit earlier this month.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Market movers and shakers: Amazon (AMZN) announced this morning it's acquiring Souq, the Arab world's biggest online retailer.

For many in the Middle East, Souq.com is the online shopping platform. The company was recently valued above $1 billion, according to CB Insights.

Shares in Australian hotel and resort firm Mantra Group surged by 12% overnight based on a local report saying Marriott (MAR) is considering a bid for the company. Mantra is worth about 872 million Australian dollars ($662 million).

Shares in Red Hat (RHT) and Darden Restaurants (DRI) were surging in extended trading as investors cheered their latest quarterly results. Darden also announced Monday it's buying Cheddar's Scratch Kitchen for $780 million in cash.

3. Swooping in for a deal: American Airlines (AAL) is moving into China's airspace with the purchase of a $200 million stake in a top Chinese carrier. China Southern confirmed the purchase Tuesday. Rumors about a deal had been swirling for awhile, causing shares in China Southern to surge last week.

4. Shudders in South Africa: Currency traders are pushing down the value of the South African rand based on fears that President Jacob Zuma is about to give the boot to his respected finance minister, Pravin Gordhan.

The rand plunged on Monday and is down a further 1% Tuesday versus the U.S. dollar.

Gordhan is the country's third finance minister in the last 18 months.

5. Earnings and economics: Carnival (CCL) is set to release earnings before the open Tuesday, while Dave & Buster's (PLAY) and Sonic (SONC) plan to release earnings after the close.

The U.S. Conference Board is set to release its March Consumer Confidence report at 10 a.m. ET.

Optimism among consumers, small business owners and CEOs shot up after the election, but it's not clear yet whether that improved sentiment will translate into economic gains.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Tuesday - U.S. Conference Board releases monthly Consumer Confidence Index; New £1 coin enters circulation in U.K.; Hillary Clinton delivers keynote speech at Professional BusinessWomen of California Conference; Carnival Corp (CCL) earnings

Wednesday - Samsung launches new Galaxy S8 smartphone; U.K. set to trigger Brexit negotiations; Lululemon (LULU) earnings

Thursday - U.S. Bureau of Economic Analysis releases updated GDP report for fourth quarter; H&M (HNNMY) earnings

Friday - Blackberry (BBRY) earnings; Final day of the first quarter of 2017