As it is shaping up, President Trump's new tax plan sounds a lot like his old one.

A Trump administration official told CNN on Tuesday that Trump may propose a major tax cut for so-called "pass-through businesses" from 39.6% to 15%.

That comes on the heels of news that Trump is also considering a big reduction in the top rate for corporations from 35% to 15%.

The Trump administration is planning to announce a tax plan on Wednesday, though it is expected to be more of an outline and not rich in detail.

The vast majority of businesses in the United States are set up as pass-throughs. They run the gamut from mom-and-pop shops to law firms and hedge funds.

A pass-through isn't taxed under the corporate code. Instead it passes its profits through to its owners, shareholders and partners, who then report those profits on their individual tax returns.

A 15% top rate for corporations and pass throughs would be drastically lower than today's rates and lower than the top rate for ordinary wage income called for under the House Republicans' tax reform proposal, as well as the plan Trump proposed last year. It remains unclear what Trump will propose on Wednesday about individual tax rates.

But a big disparity between business and wage rates worries policy experts. Why? Owners of pass-throughs who also work at those firms will be tempted to recharacterize their paychecks as "business" income to get the lower tax rate.

Related: A fatal flaw in Trump's tax cut: Senate rules

Such a dramatic rate cut would also likely set up a clash with Republican leaders on Capitol Hill.

While they are eager to cut business taxes, for various reasons they don't want to add to the country's debt. And a 15% business tax rate could drive up deficits by a lot.

For example, the Tax Policy Center estimated in November that Trump's 15% proposal for corporations and pass-throughs, coupled with a repeal of the corporate Alternative Minimum Tax, could reduce revenue by nearly $4 trillion in the first decade.

To put that in context, that's close to $400 billion a year -- which is more than the $304 billion the government spent last year on income security programs such as food stamps, unemployment benefits and child nutrition, according to numbers from the Congressional Budget Office.

Related: Trump relies on magic wand of growth to pay for tax cuts

The price tag could be somewhat less if Trump chose not to repeal the corporate AMT. But if he didn't, that would greatly undercut the value of the rate reduction to 15% for many corporations because they would have a higher tax bill under the AMT, said Roberton Williams of the Tax Policy Center.

The TPC was working off a plan from the Trump campaign that was thin on details. So absent those, it's hard to do a more tailored cost estimate.

But it's very fair to assume the cost of reducing the top business tax rate will be high.

Administration officials cautioned that nothing is final. And sources told CNN that Wednesday's announcement is not likely to offer much explanation for how tax reductions would be paid for.

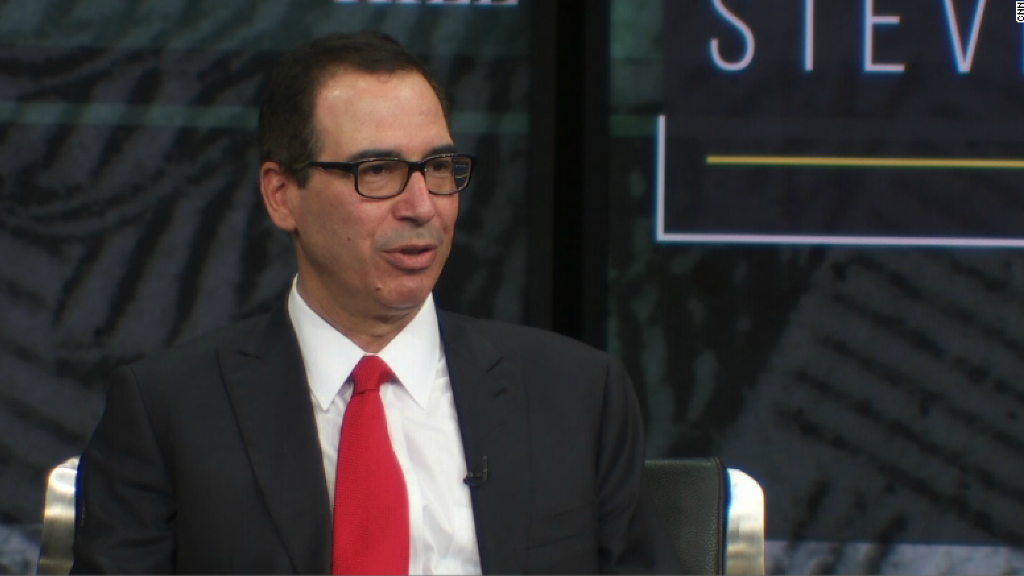

Treasury Secretary Steven Mnuchin has said, however, that Trump's tax plan would be paid for through economic growth. Experts throw cold water on that idea, since there is no evidence that tax cuts pay for themselves.

The Wall Street Journal first reported that Trump wants to include a 15% corporate and pass-through rate in Wednesday's announcement.

Senate Finance Chairman Orrin Hatch on Monday said that a 15% corporate tax rate would be problematic because it would increase the deficit and run into parliamentary problems if Republicans try to pass their tax bill under a procedure that lets them avoid a filibuster.

"I'd love to do that. [But] I'm not sure we can get them down that low," Hatch said when asked about the proposed rate.

Trump won't back controversial House border tax

The White House also told CNN that the Trump plan will probably not include a controversial provision known as the border adjustment tax that was proposed by House Republicans.

Under such a provision, companies could no longer deduct the cost of their imported goods, and the sales of their exports would no longer be subject to U.S. tax.

A border adjustment tax could raise more than $1 trillion over a decade. House Republicans were counting on that to help offset the cost of their proposed rate cuts.

Administration officials also said the president, as he did during the campaign, will call for a one-time low tax on U.S. multinationals' trillions of dollars in foreign profits that have never been brought back to the United States.

--CNN's Jeff Zeleny, Jim Acosta and Manu Raju contributed to this report.