President Trump's proposed 15% tax rate on all business income could create a huge tax dodge that will be hard to guard against, experts say.

Proponents of such a low rate believe it will help the economy.

But in the context of Trump's other proposals, it also may help individuals shelter their income, warned Martin Sullivan, chief economist at Tax Analysts.

That's because there's a big difference between Trump's proposed 35% top rate for individual income and the 15% rate he would apply to income from so-called pass-through entities as well corporations.

Pass-throughs make up the majority of U.S. businesses. They don't pay tax directly, but rather pass their profits through to their owners, partners and shareholders. They, in turn, pay tax on those profits on their personal returns at their individual income tax rates.

So having a yawning gap between the top wage rate and the top business rate will tempt taxpayers to convert as much of their ordinary income into business income as possible, saving them $20,000 for every $100,000 subject to tax. On top of that they'd save money because they would escape the 2.9% Medicare tax owed on wage income.

Related: Trump calls for dramatic tax cuts for individuals and businesses

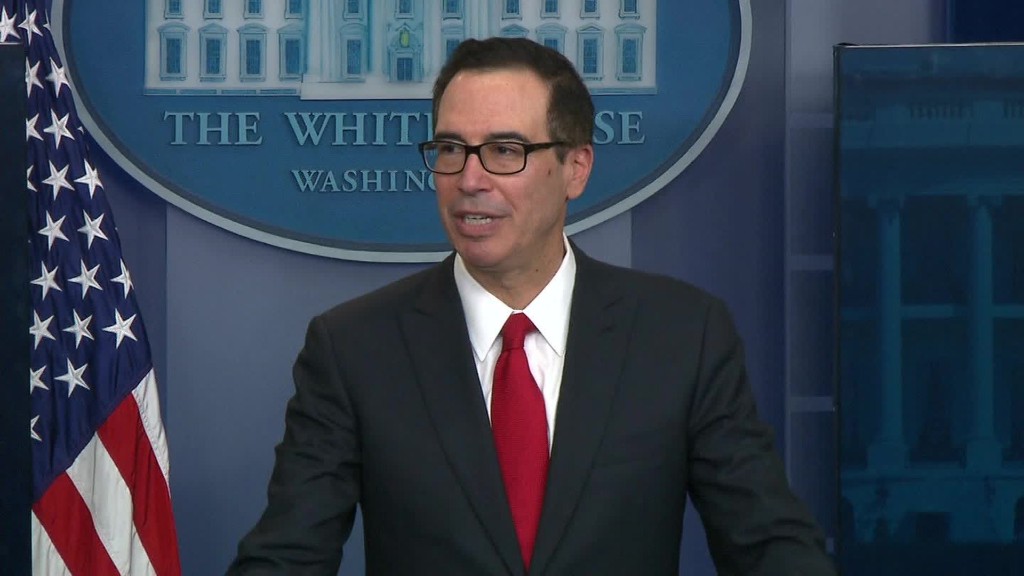

Treasury Secretary Steven Mnuchin has promised that rules would be created to prevent people from abusing the pass-through structure just to slash their tax bills.

But rules to prevent gaming are hard to develop and even harder to enforce. And they would complicate the code.

"There will always be huge administrative costs and concerns for the IRS, and huge compliance costs and concerns for taxpayers," Sullivan said.

Why? Because rules work best when there are bright lines. But there are not bright-line definitions of what a reasonable market-rate salary for a business owner or employee-shareholder should be vs. profits they are entitled to vs. a reasonable return on their investment of sweat equity.

"There's no hard and fast rule. It's a judgment call. It's facts and circumstances," Sullivan said.

The same goes for determining who is a full-time employee versus a contractor.

Related: The two biggest ways the Trump family could benefit from his tax plan

The concern about Trump's low business tax rate is not just that wealthy business owners will abuse the system. It's that millions of people will start calling themselves independent contractors just to get the 15% tax rate, even if they work full-time for one company.

"I would benefit from going to my employer and ask[ing] them to start paying me as an independent contractor. I would still be doing the same job and contributing the same value to the economy," Scott Drenkard, director of state projects for the Tax Foundation, said in recent testimony to Congress.

The only difference: The contractor would get to pay the 15% rate on his pay.

It's not an idle worry. Kansas exempted all pass-throughs from the income tax in 2012. Unsurprisingly, revenues dropped ... a lot. Lawmakers have been scrambling to make up the difference ever since.

The same could very well happen at the national level, regardless of economic growth.

"The pass-through carve out [in Kansas] is primarily incentivizing tax avoidance, not job creation," Drenkard said.