1. Oh, snap!: Shares in Snap (SNAP) fell as much as 25% in extended trading after the company posted a staggering loss in its debut quarter as a public company.

The parent company of Snapchat suffered a loss of $2.2 billion in the March quarter, while sales totaled only $150 million.

Snap is facing fierce competition from Facebook (FB), which has incorporated Snapchat-like camera features into Instagram and Whatsapp.

2. Retail earnings: Macy's (M) and Kohl's (KSS) are set to report earnings before the bell on Thursday. Both are expected to reveal shrinking profits.

Retailers have been struggling with falling sales, and many have been forced to cut jobs and close stores.

Shares in Macy's and Kohl's have lost about one-fifth of their value this year.

Nordstrom (JWN) will report after the closing bell, and it is expected to deliver a more upbeat message. The upscale retailer's stock has outperformed many of its peers.

3. Laptop ban: Department of Homeland Security officials will speak with airline industry representatives on Thursday about the electronics ban on aircraft as the agency considers an expansion of a security measure, according to DHS and industry sources.

According to media reports, the ban on large electronics could be expanded to include flights from Europe.

European airline stocks were lower in early trading, but losses were mild.

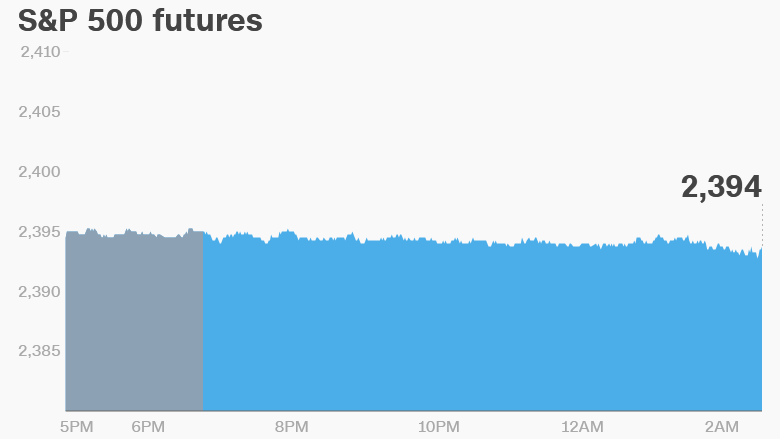

4. Global market overview: U.S. stock futures were lower early Thursday.

European markets opened mixed, while Asia finished the session mostly higher.

The Dow Jones industrial average closed 0.1% lower on Wednesday, while the S&P 500 and the Nasdaq were both 0.1% higher.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Stock market movers -- Whole Foods: Shares in Whole Foods (WFM) surged in extended trading after the company announced Wednesday it is getting a new chief financial officer, chairman and is replacing five board members.

6. Economics: A three-day meeting of G7 finance ministers starts in Italy on Thursday.

Italian officials have said they will keep international trade off the official agenda, to avoid disagreements between the U.S. and other members.

Britain's central bank will announce a decision on interest rates and its monthly inflation report at 7 a.m. ET on Thursday. This will be followed by a press conference by the bank's governor Mark Carney at 7:30 a.m. ET.

The press conference comes at a sensitive time -- the U.K. will hold a general election in early June.

Download CNN MoneyStream for up-to-the-minute market data and news

The European Commission published its spring economic forecast Thursday morning. It expects the euro area to grow 1.7% in 2017, up from the 1.6% rate it forecast in February. It expects "steady growth" for EU as a whole, but the picture will vary across member states.

7. Coming this week:

Thursday -- Kohl's and Macy's earnings; G7 summit; EU economic forecast; Bank of England rate decision and inflation report

Friday -- U.S. inflation data; University of Michigan Confidence Survey; JCPenney earnings; Retail sales report; G7 summit day 2; German GDP data