It looks like a trade war between the world's two biggest economies has been avoided, for now.

The deal the U.S. and China just struck on agricultural trade, financial services, investment and energy is evidence of President Trump's increasing willingness to negotiate with Beijing.

During his campaign for office, Trump threatened belligerent moves such as slapping tariffs on imports.

"It's another encouraging sign that Trump's willing to cooperate with China rather than adopt the confrontational and protectionist stance he threatened during the election," said Julian Evans-Pritchard, an economist at Capital Economics, about Thursday's agreement.

"It's clear, at least in the near term, that fears about a trade war have receded significantly."

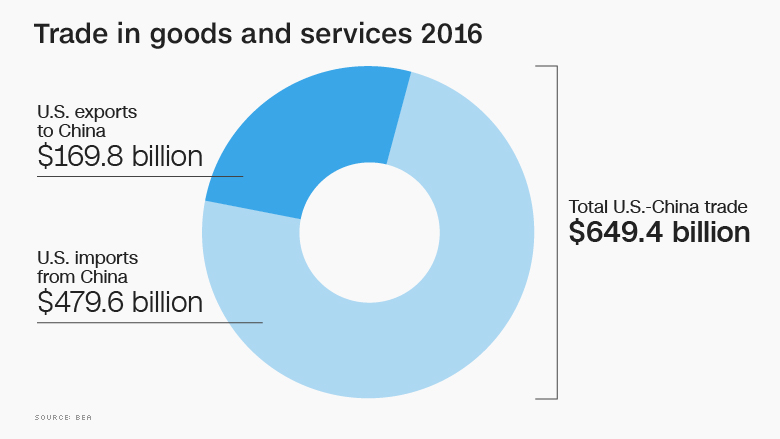

What is far less clear is whether Trump's first deal with China will do much to narrow the U.S. trade deficit, which stood at $347 billion last year.

Related: China's new world order

U.S. Commerce Secretary Wilbur Ross said the initial agreement would help "bring down" the deficit with China, without providing a precise estimate.

Related: What's at stake for U.S. in a trade war with China

China will allow U.S. beef exports to flow directly to the country for the first time since 2003, and the U.S. will take steps to authorize Chinese imports of cooked poultry.

The deal will also open up U.S. exports of liquefied natural gas to China.

Exports of beef and gas were unlikely to shift the balance of trade in a big way, Evans-Pritchard said.

A narrow deal

"It's quite a narrow deal. It's not going to have a meaningful impact on the trade deficit that the U.S. has with China."

Based on data from Japan, the world's biggest importer of U.S. beef, Evans-Pritchard estimated that the beef element of the deal could reduce the deficit by $3.5 billion at most.

Natural gas exports may move the needle a little more but China's total imports of the fuel are still quite small, worth about $17 billion last year, he added. And there are plenty of other players competing for that business.

Long term potential

Longer term, the deal on financial services could be much more significant. U.S. electronic payment providers will gain access to the Chinese market, while Chinese banks should gain broader access to U.S. customers.

"That's an open door for huge business potential for U.S. companies," said Shen Jianguang, chief Asia economist at Mizuho Securities.

Related: Why is Trump backing off his China threats

The deal is the first sign of progress on the 100-day action plan that Trump and Xi called for during their meeting at Trump's Florida estate in April.