1. Gulf in crisis: Stocks in Qatar plummeted as much as 8% on Monday amid a major diplomatic crisis in the Gulf.

Saudi Arabia, Bahrain, the United Arab Emirates, Egypt and Yemen all said they had cut diplomatic ties with Qatar over claims that it supports terrorism. Qatar says the move is "unjustified."

The first wave of economic fallout was immediate: Etihad, Emirates and FlyDubai announced they are halting all flights in and out of Doha, the Qatari capital, starting Tuesday morning.

Uncertainty in the oil-rich region helped boost energy prices. U.S. crude futures gained 0.6% to trade just below $48 per barrel.

2. London terror attack: Britain was getting back to business on Monday after the country suffered its third terror attack in less than three months. Seven people were killed in a brazen assault in central London late Saturday.

Prime Minister Theresa May has said that a crucial general election scheduled for Thursday will go ahead as planned.

The pound dipped slightly against the dollar to trade just above $1.28.

London's benchmark FTSE100 opened lower. Travel companies including EasyJet (ESYJY), British Airways' owner IAG (ICAGY) and vacation company Thomas Cook were among the biggest losers, shedding as much as 2%.

3. Apple conference: The tech world will turn to the start of Apple's Worldwide Developers Conference on Monday.

Reports suggest Apple (AAPL) could reveal updates to key devices, in addition to the usual focus on software. CEO Tim Cook is expected to take the stage at 1 p.m. ET.

Apple was down almost 1% in premarket trading on Monday.

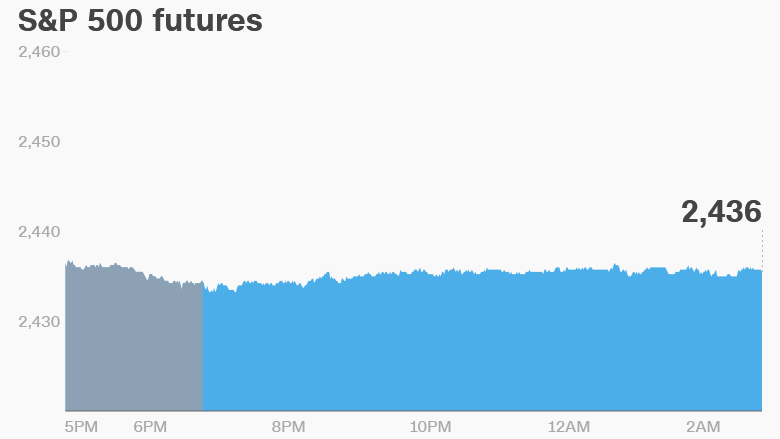

4. Global market overview: U.S. stock futures were trading slightly lower.

Asian markets ended the session mixed. European markets declined in early trading. German markets were closed for a holiday.

Gold prices jumped 0.3%.

The Dow Jones industrial average closed up 0.3% on Friday, while the S&P 500 gained 0.4%. The Nasdaq surged almost 1% to hit a new record high.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Economics: The Institute for Supply Management releases its May non-manufacturing business activity index at 10 a.m. ET.

The U.S. Census Bureau will release data on factory orders at the same time.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Monday - Apple (AAPL) Worldwide Developers Conference

Tuesday - Lands' End earnings

Wednesday - House budget hearing on Trump's pro-growth policies; House debates Dodd-Frank reforms overhaul; U.S. crude inventories data; Australia Q1 GDP data; China foreign exchange reserves data;

Thursday - Yahoo shareholders vote on Verizon deal; U.S. treasury Secretary Steven Mnuchin meets with House members over debt ceiling; Former FBI director Jim Comey to testify before Senate; Dell earnings; U.K. election; China trade data

Friday - Tim Cook delivers MIT commencement speech