1. Calm before the storm: Markets are relatively peaceful. That could be because of what looms on Thursday.

Investors are preparing for a deluge of major events over the next 48 hours. U.K. voters will be going to the polls on Thursday in a crucial general election that promises to shape the country's departure from the EU. The European Central Bank will also meet on Thursday.

In the U.S., former FBI Director James Comey will testify in public on Thursday about the investigation into potential coordination between the Trump campaign and Russian officials.

Investors are bracing ...

2. Trump and taxes: But back to Wednesday. President Trump's promise of massive tax cuts will be in focus today.

The House budget committee is scheduled to hold a 10:00 a.m. ET hearing on the economic benefits of Trump's "pro-growth policies."

Trump campaigned on promises to slash taxes, cut regulation and increase infrastructure spending. But little progress has been made so far.

3. €1 bank rescue: Spain's Santander (SAN) has acquired troubled rival Banco Popular for €1 ($1.13) after Europe's regulators declared the bank "likely to fail."

The purchase will make Santander the country's biggest bank in terms of both lending and deposits, serving over 17 million customers.

Santander said it will raise about €7 billion ($7.9 billion) to fund the rescue deal.

4. Australia's growth streak: Australia has posted yet another quarter of economic growth, bringing its impressive run without a recession to nearly 26 years.

Growth has been slowing, however, while weak wages and the rising cost of living are squeezing real incomes.

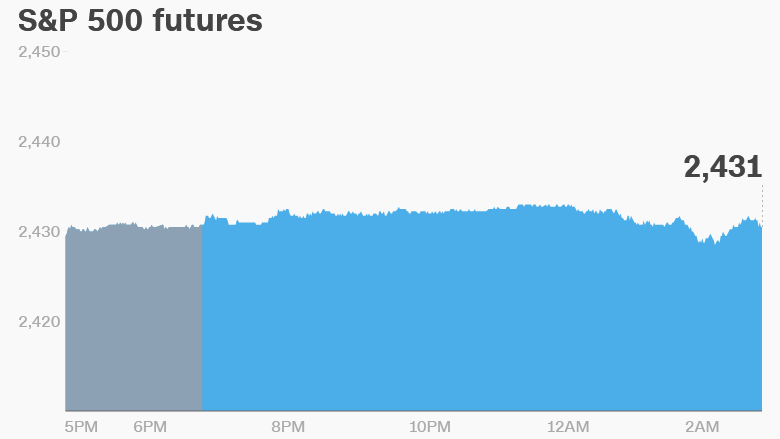

5. Global market overview: U.S. stock futures were flat.

European markets opened higher, while Asian markets ended the session mixed.

Oil prices dropped almost 1% to trade at $47.70 per barrel.

The Dow Jones industrial average closed 0.2% lower on Tuesday. The S&P 500 and the Nasdaq both lost 0.3%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

6. Earnings and economics: Jack Daniel's owner Brown-Forman (BFA) and At Home Group (HOME) will post quarterly earnings before the opening bell.

Results are on tap after the close from Tailored Brands (TLRD), the owner of Men's Wearhouse and Jos A. Bank.

The Mortgage Bankers Association will release weekly mortgage application data at 7:00 a.m.

The weekly U.S. crude inventories report is set to be released at 10:30 a.m.

Consumer credit data are expected at 3:00 p.m.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Wednesday - House budget hearing on Trump's pro-growth policies; House debates Dodd-Frank reforms overhaul; U.S. crude inventories data; Australia Q1 GDP data; China foreign exchange reserves data

Thursday - Yahoo shareholders vote on Verizon deal; U.S. treasury Secretary Steven Mnuchin meets with House members over debt ceiling; Former FBI director Jim Comey to testify before Senate; Dell earnings; U.K. election; China trade data

Friday - Tim Cook delivers MIT commencement speech