China has agreed to fund investments in Russia worth billions of dollars, helping Moscow bypass Western sanctions.

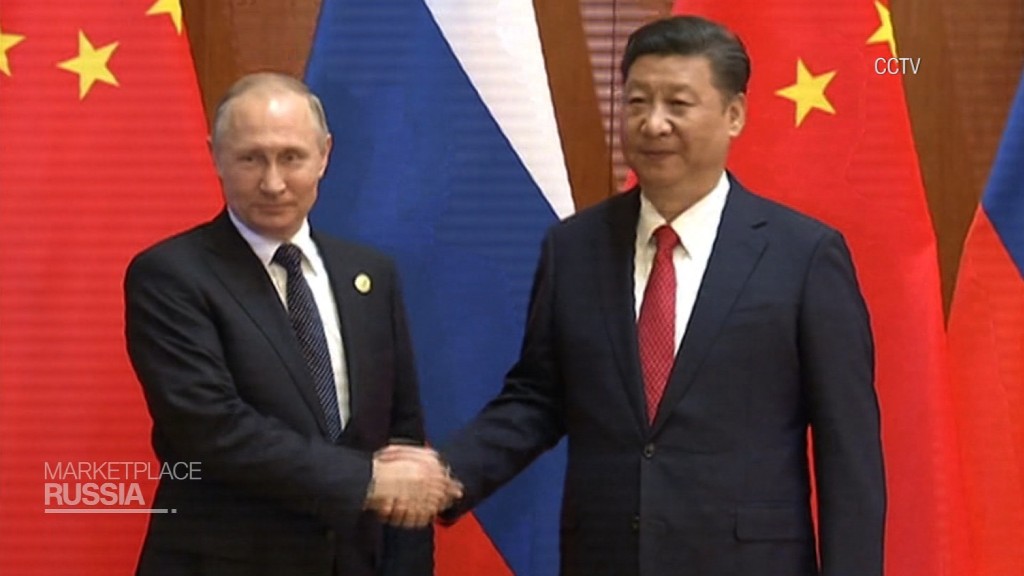

The deals were struck during a visit to Russia this week by Chinese President Xi Jinping.

China Development Bank and the Russian Direct Investment Fund (RDIF), a sovereign wealth fund which invests in infrastructure, energy, industry and other sectors, said they would create a joint investment fund worth 68 billion yuan ($10 billion). The money will finance infrastructure and development projects.

VEB, Russia's state development bank, also signed a deal with China Development Bank for a new 15-year loan worth 50 billion rubles ($850 million) to set up a new innovation fund.

RDIF and VEB are subject to U.S. sanctions imposed on Russia over its involvement in the Ukraine conflict. They are barred from raising long term finance in the U.S. VEB is also under sanctions by the European Union.

"Because they are subject to U.S. and EU sanctions, they are cut off from Western capital," said Sean Kane, counsel at Hughes Hubbard and a former deputy Assistant Director for Policy in the Office of Foreign Assets Control (OFAC) in the U.S. Department of the Treasury.

"That was the purpose of these sanctions, to cut these entities off long term financing in the U.S. and EU," added Kane, who was involved in the development and implementation of the Russia sanctions program.

The White House did not respond to CNNMoney's request for comment.

Related: How Russia and China are bonding against the U.S.

Russia has been keen to attract more investment from China ever since sanctions were imposed in 2014, and oil prices collapsed.

But Moscow so far has little to show for its efforts. Russia did sign a 30-year deal in 2014 to supply natural gas to China, worth an estimated $400 billion.

China had refused to sign the gas deal for several years, unhappy with the price Russia was asking. The financial details of that deal have not been released, but analysts have said it was likely favorable to China.

"Everyone knew the Russians could go to China for financing," said Kane, pointing to the gas deal. "China can, and has, extracted a pretty high price for these deals."

"I would not be surprised if China got a very good deal here," Kane added, referring to this week's investment agreements.

The new investment funds will be set up in Russia and China's own currencies, rather than dollars or euros, putting them way beyond the reach of the U.S. and European sanctions regimes.

Western sanctions against Russia do not apply to China.

RDIF said existing sanctions should not prevent U.S. investors from co-investing or creating funds with RDIF similar to the one established with CDB.

Kane said it would come down to the specifics of each arrangement, given that OFAC tends to apply a broad definition to new financing.

Related: Putin meets Xi: Two economies, only one to envy

The actual investment, equivalent to nearly $11 billion, is tiny in the context of China's ambitious One Belt One Road initiative, a trillion-dollar plan that spans about 65 countries and 4.4 billion people, according to PwC.

Under the Belt Road plan, China will pour money into railroads, highways and other projects in former Soviet states such as Kazakhstan and Uzbekistan.

But this week's deals with China are politically important for Russian President Vladimir Putin.

"Russia certainly has vested interest in publicizing these deals. It is very important to President Putin to show that Russia is not cut off the world," Kane said.

"It's also a way to reinforce the message that these sanctions are not working -- because Russia can get financing elsewhere."