1. Health care failure: Investors are not very impressed with news coming out of Washington.

President Trump's effort to repeal and replace Obamacare came to a screeching halt Monday night after Senators Mike Lee of Utah and Jerry Moran of Kansas vowed to vote against the latest draft of the health care bill.

The dollar index -- which compares the greenback to its global peers -- declined to its lowest level since September.

Investors are worried about the Trump administration's ability to follow through on its economic agenda.

"Six months in office and with no major legislation signed into law, it seems that the 'The Art of the Deal' hasn't worked so far in U.S. politics," said Hussein Sayed, chief market strategist at FXTM. "With tax reforms now likely to face huge uncertainties and economic data signaling [a] slowing economy, it will only be a matter of time before U.S. corporate earnings take a U-turn."

The Dow Jones industrial average and S&P 500 hit record highs earlier this month. The Nasdaq has advanced for seven trading sessions in a row.

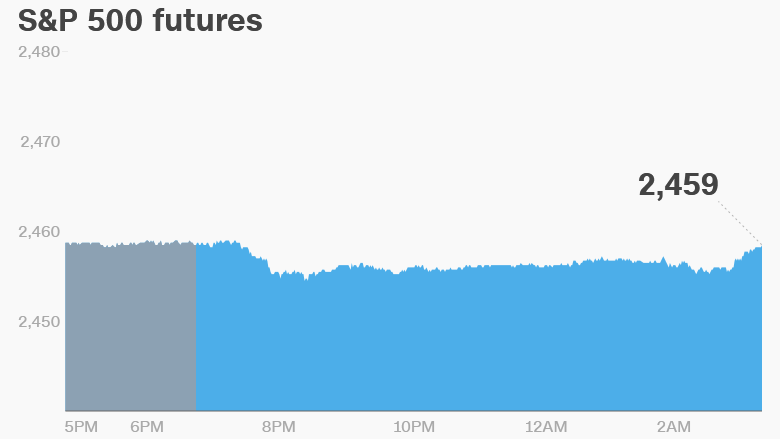

U.S. stock futures were flat on Tuesday.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Earnings: It's going to be a big day for earnings.

Goldman Sachs (GS), Bank of America (BAC), Harley-Davidson (HOG), Johnson & Johnson (JNJ) and Lockheed Martin (LMT) will report earnings ahead of the open.

IBM (IBM) and United Continental (UAL) will report after the close.

United was at the center of a firestorm in April after a passenger was beat up and dragged off a fully-booked flight. Investors will be interested to see if the public backlash ended up hurting the company's bottom line.

3. Netflix and thrill: Investors are thrilled by the latest earnings from Netflix (NFLX).

Shares in the entertainment company are surging by about 10% premarket after the firm reported that millions of new subscribers had joined up thanks to its lineup of original shows.

The firm added more than 5 million subscribers in the latest quarter, bringing its total subscriber base to about 104 million.

The vast majority of new subscribers came from overseas markets. Netflix's international subscriber base is now larger than the U.S. for the first time.

Meanwhile, shares in Swedish telecom equipment firm Ericsson (ERIC) plunged by about 10% in Europe after the company released worse-than-expected quarterly earnings. Shares are set to drop on the Nasdaq when trading begins in New York.

Download CNN MoneyStream for up-to-the-minute market data and news

4. Coming this week:

Tuesday -- Goldman Sachs (GS), Bank of America (BAC), Harley-Davidson (HOG), Johnson & Johnson (JNJ), IBM (IBM) and United Continental (UAL) earnings

Wednesday -- Morgan Stanley (MS), American Express (AXP), T-Mobile US (TMUS) earnings

Thursday -- Microsoft (MSFT), eBay (EBAY) and Visa (V) earnings; Carrier layoffs begin; European Central Bank and Bank of Japan announce policy decisions

Friday -- General Electric (GE) and Honeywell (HON) earnings