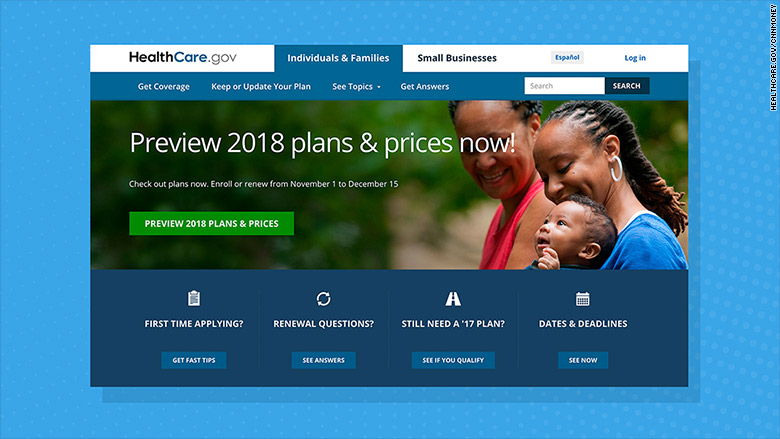

Consumers can now check out how much Obamacare will cost them in 2018.

The window shopping tool for the federal exchange, healthcare.gov, went live on Wednesday, allowing folks to start comparing plans a week before open enrollment begins.

What they find may shock them, especially if they aren't eligible for federal premium subsidies. Premiums for silver plans -- the most popular on the exchanges -- will rise an average of 34% in the more than three dozen states that use the federal exchange, according to a new analysis from Avalere, a consulting firm. The hikes vary by state, with Iowa seeing the largest average silver plan rate increase at 69%.

Many insurers hiked the price of their silver policies for 2018 to offset President Trump's elimination of the funding for Obamacare's cost-sharing subsidies. These payments, made directly to insurers, reduce deductibles and co-pays for lower-income enrollees.

Trump had threatened to eliminate the funding all year, finally doing so earlier this month. Those who earn too much to qualify for premium subsidies will be hit the hardest.

Related: Trump's quest to kill Obamacare hurts the middle class

But in a strange twist, those eligible for premium assistance could actually find themselves able to buy gold plans -- which have lower deductibles -- for less than or the same price as the silver policies. That's because they'll likely receive more generous subsidies, which will make the gold plans more affordable.

Here's why: Most state regulators directed insurers to compensate for the loss of the cost-sharing subsidy funding by hiking only the prices of their silver plans, knowing the premium subsidy would shield eligible enrollees from the increase.

"People will see much better deals in those states," said David Anderson, research associate at Duke's Margolis Center for Health Policy.

Gold plan premiums are rising by 16% on average, while the prices for bronze plans, which have lower rates but higher deductibles, are increasing by an average of 18%, according to Avalere.

Related: Actually, Trump is raising health insurance premiums

This makes it even more crucial for consumers to shop for 2018 coverage during open enrollment, which runs through Dec. 15. Those who don't may find themselves missing out on more affordable coverage or, even worse, stuck with much costlier plans or no coverage at all. Premium subsidies are based on the second lowest cost silver plan, but this benchmark policy can change year to year.

The window shopping tool is one of several features the Trump administration is keeping for the open enrollment season. However, it is making many other changes that critics say will sabotage Obamacare.

First, what's staying the same:

Call centers will be staffed: Roughly the same number of call center representatives will be available to answer enrollment questions. Last year, staffing peaked at 11,000 people, according to the administration. New this year will be a call-back feature so consumers can opt to get a return call, rather than wait on hold.

Waiting rooms could be deployed if needed: As in prior years, consumers may be put in virtual "waiting rooms" when healthcare.gov traffic is high. Users will see a message asking them to stay on the page, which will refresh when they can continue with enrollment.

And here's what's new:

A big change for auto re-enrollment: The Trump administration will once again automatically re-enroll consumers who don't actively select a plan by Dec. 15. However, unlike in prior years, participants won't be able to switch to another policy after that date. That's because open enrollment ends on Dec. 15, whereas it continued at least through the end of January in previous years.

This is a big deal because some policies will be far costlier next year. Consumers may get stuck if they don't shop around.

Enrolling outside of healthcare.gov: Consumers will now be able to enroll directly through certain third-party websites, rather than having to go to healthcare.gov to complete their applications.

Also, the federal exchange will make it easier for consumers to connect with agents and brokers for assistance with applications through a new "Help on Demand" service.

The Trump administration says this will provide Americans with more ways to enroll. Critics, however, worry that applicants may be steered to certain insurers' products and may not be told of less-expensive options.

The open enrollment features released Wednesday follow many other changes Trump officials are instituting that experts say will likely dampen sign-ups. These include cutting the enrollment period in half, cutting funding to non-profit groups that help consumers pick plans and slashing the advertising budget by 90% -- not to mention, Trump's repeated declarations that Obamacare is dead.

Related: Trump administration is making it even harder to sign up for Obamacare

The administration said Wednesday that it will target the uninsured, as well as young and healthy enrollees who plan to sign up again, in its marketing campaigns. It will use YouTube videos, social media, mobile and search advertising, emails, texts and autodial messages to reach out to consumers.

What the administration is not doing is television, radio and direct mail advertising. TV, in particular, is the most effective way to drive people to enroll, said Lori Lodes, a former Obama administration official who co-founded the Get America Covered campaign to try to boost enrollment.

Trump officials seem to be interested in making sure consumers get help while enrolling, Lodes said. However, the Trump administration isn't looking to boost the number of Americans signing up for Obamacare.

"They are only focused on the consumer experience, which is great, but they also need to be focused on making sure people get enrolled," she said.

The cuts to the advertising budget could reduce Obamacare enrollment by at least 1.1 million, estimates Joshua Peck, co-founder of the Get America Covered campaign and former chief marketing officer for healthcare.gov.