1. Oil slick: Political turmoil in the Middle East has driven crude oil prices to $57, their highest level in more than two years.

Investor attention has focused on Saudi Arabia, where scores of princes, high-profile businessmen and government officials were arrested over the weekend in a crackdown on corruption.

The threat of conflict with Iran has also unnerved markets. Saudi is fighting a proxy war with its regional rival in Yemen, and there have been signs of escalation in recent days.

"Conflicts within the Middle East are becoming a major influencer on energy markets, and a further surge in [oil] prices will likely be due to political risk," said Hussein Sayed, chief market strategist at trading platform FXTM.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Stock market movers -- Priceline, TripAdvisor, 21st Century Fox: Shares in Priceline Group (PCLN) and competitor TripAdvisor (TRIP) were down 9% in premarket trading after the companies released earnings on Monday.

21st Century Fox (FOX) stock could be volatile following reports that said the company was recently in talks to sell key assets to Disney (DIS).

CNBC reported that the deal would have seen Fox selling its movie studio, television production unit and entertainment networks to Disney. Fox would keep its news and sports holdings and its broadcast network.

Several reports said the talks were no longer active, but 21st Century Fox shares gained 10% on Monday.

21st Century Fox (FOXA) declined to comment. Disney (DIS) did not immediately respond to a request for comment.

3. Earnings: Royal Caribbean (RCL), SeaWorld Entertainment (SEAS), Coach parent company Tapestry (TPR) and Weibo (WB) are all reporting quarterly earnings before the open.

Fossil (FOSL), Marriott (MAR), Planet Fitness (PLNT), Take-Two Interactive (TTWO), Snap (SNAP) and Zillow (ZG) will follow after the close.

Shares in tobacco company Imperial Brands were trading higher in London after the company gave a well-received quarterly update.

Toyota (TM) released earnings showing car sales increased in the first half of the fiscal year, but operating profit declined because of higher expenses and marketing activities.

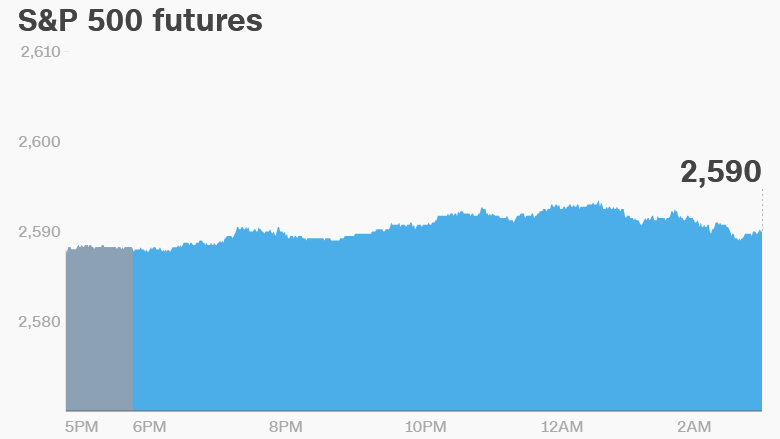

4. Global market overview: U.S. stock futures were holding steady after the main indexes rallied to new record highs on Monday.

European markets were mixed in early trading, but the moves were small.

Many Asian markets ended the day with solid gains. The Nikkei was a standout performer, rising by 1.7%.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Tuesday -- Snap (SNAP) earnings; JOLTS report on job openings

Wednesday -- First anniversary of the U.S. presidential election

Thursday -- Nordstrom (JWN), Macy's (M), Disney (DIS) and News Corp (NWS) earnings

Friday -- Consumer confidence survey