1. Retail trouble: Macy's (M) and Nordstrom (JWN) will report results on Thursday and Wall Street is bracing for more signs of a retail apocalypse.

The department stores are likely to paint a gloomy picture about their busiest and most critical time of the year.

Morgan Stanley recently warned that sales will outright decline during the holiday quarter at both companies.

It's yet another sign that the rise of Amazon (AMZN) and resurgence of Walmart (WMT) have taken a toll on many traditional retailers.

2. Trump deals in China: U.S. and Chinese officials are touting more than $250 billion in deals signed during President Trump's visit to China.

The agreements span energy, aviation and technology. However, a number of the deals signed were only framework agreements, meaning the details are still up for negotiations.

Boeing (BA) and Qualcomm (QCOM) have both announced deals during the trip.

3. AT&T and Time Warner: AT&T's acquisition of Time Warner (TWX) has hit a serious snag.

Negotiations between the companies and the U.S. Department of Justice have turned so contentious that now both sides are arguing publicly over what the dispute is even about.

Both sides agree that there was a pivotal meeting on Monday between AT&T (T) CEO Randall Stephenson and DOJ's antitrust chief Makan Delrahim.

The two men discussed asset sales that might satisfy the government's concerns, but sources offer differing accounts of that conversation.

CNN, which is owned by Time Warner, is one of the assets that has been mentioned in multiple reports.

"Throughout this process, I have never offered to sell CNN and have no intention of doing so," AT&T CEO Randall Stephenson said in a statement on Wednesday.

4. Burberry falls: Shares in Burberry (BBRYF) fell more than 10% in London after the company said it does not expect sales to increase until fiscal 2021.

CEO Marco Gobbetti also said that he wants to shift the fashion brand upmarket — a change analysts say could be costly.

"The transition is bound to be painful," said Luca Solca, head of luxury goods at Exane BNP Paribas.

Burberry announced in late October that long-time creative director Christopher Bailey would be leaving the company.

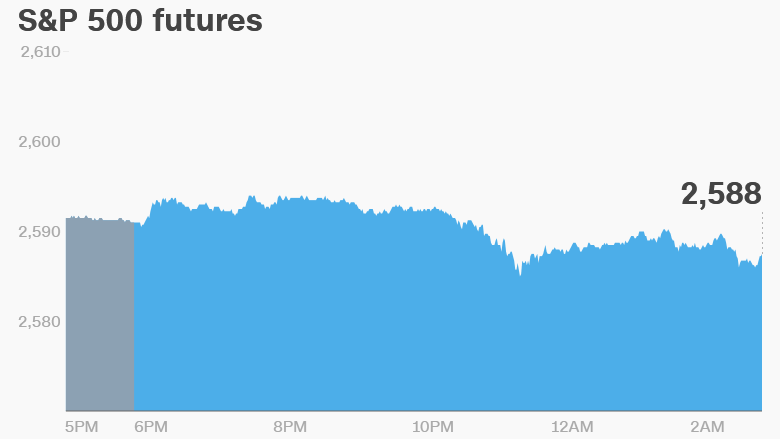

5. Global market overview: U.S. stock futures were in negative territory.

European markets were mixed, following a similar session in Asia.

The Dow Jones industrial average closed at a new record high for a fifth day in a row on Wednesday. The S&P 500 and the Nasdaq also hit all-time highs.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

6. Earnings and economics: Disney (DIS) will release its fourth quarter results after the close. CEO Bob Iger warned in September that earnings could be flat this quarter.

Canada Goose (GOOS), DISH Network (DISH), Kohl's (KSS), Norwegian Cruise Line (NCLH), Office Depot (ODP), Party City (PRTY), Time (TIME), and TransCanada (TRP) will release earnings before the opening bell.

Franklin Covey (FC), Kona Grill (KONA), Lions Gate Entertainment (LGFA), News Corp. (NWSA), Noodles & Co (NDLS) and NVIDIA (NVDA) will follow after the close.

China inflation data came out slightly above expectations on Thursday, with prices rising 1.9% over the previous year in October.

The European Commission will publish its Autumn European Economic Forecast.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Thursday -- Nordstrom, Macy's, Disney and News Corp (NWS) earnings

Friday -- Consumer confidence survey