1. Black Friday: U.S. stock markets will close early on Friday, but retailers are hoping that shoppers go all day and night.

Shoppers are expected to spend more than ever before during the coming weeks -- an average of $967 each, according to the National Retail Federation. That's up 3% from last year.

But it's the first time that Americans plan to shop more online than in big box stores like Walmart (WMT) or Target.

It's been a terrible year for traditional retailers so far. Store closings have more than tripled to a record 6,700 and several prominent retailers such as Toys R Us, Gymboree, Payless Shoes and RadioShack have filed for bankruptcy.

2. German politics: Europe's top economy may be closer to forming its next government.

According to reports in German media, the opposition party SPD say it's now open to coalition talks with Chancellor Angela Merkel.

Merkel has struggled to form a government since her election victory in late September -- and some fear another election could be required.

Meanwhile, a key measure of business confidence published by Germany's IFO hit a record high in November. A survey of Eurozone purchasing managers released Wednesday showed a sharp jump in business confidence and hiring at its highest level in 17 years.

Investors cheered the news. Germany's DAX jumped 0.2% and the euro gained against major currencies.

3. Oil nears $60: U.S. crude gained more than 1% Friday to trade at $58.50, its highest level in 29 months.

Prices have increased this week after the Keystone pipeline was disrupted.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

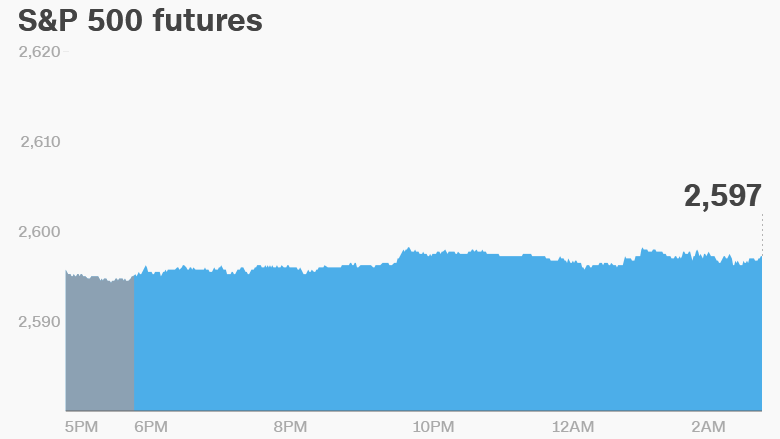

4. Global market overview: U.S. stock futures were edging higher on Friday, but trade quickly: Markets close at 1:00 p.m. ET.

European markets opened mixed. Most Asian markets posted gains.

The Dow Jones industrial average closed 0.3% lower in the trading session before Thanksgiving. The S&P 500 dropped 0.1% while the Nasdaq gained 0.1%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Stock market movers: Shares in Mitsubishi Materials plunged as much as 11% in Tokyo after the firm came clean about faking quality data on parts used in aircraft and cars. The practice stretched back a year.

6. Economics: Mexico will publish its latest GDP data at 9:00 a.m. U.S. manufacturing and services PMI will be released at 9:45 a.m.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Friday -- Markets close at 1 p.m.; Black Friday