1. Tax bill finale: Republicans are very close to delivering a huge tax overhaul.

Party leaders agreed on the final text of their tax bill last week and made it public on Friday. The House is expected to vote on Tuesday, and the Senate will follow soon after.

The bill, which is expected to pass on party lines, could be on President Trump's desk before Christmas.

The measure drops the corporate tax rate to 21% from 35%, repeals the corporate alternative minimum tax and restructures the way pass-through businesses are taxed.

2. Markets surge: All three main U.S. stock indexes hit record highs on Monday as investors cheered the tax bill's progress.

The Dow Jones industrial average added 0.6%, the S&P 500 gained 0.5% and the Nasdaq advanced 0.8%.

The Dow, which has jumped more than 25% in 2017, is now within touching distance of 25,000 points.

Stocks have rallied this year because of strong economic growth and hopes that Trump would roll back regulations and overhaul the tax code.

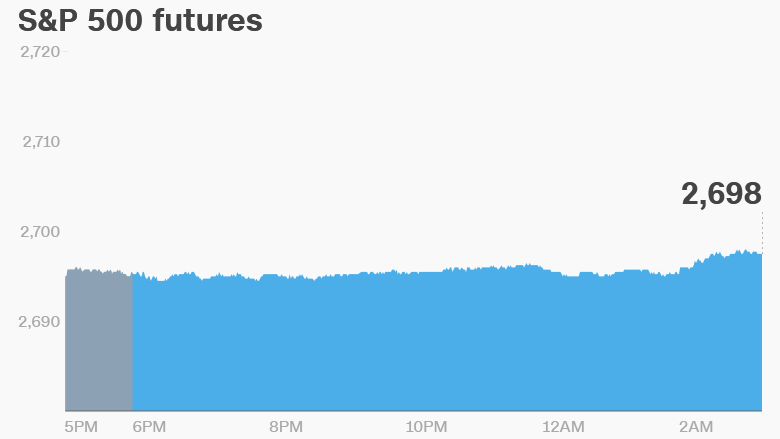

U.S. stock futures were pointing higher on Tuesday.

3. Bombardier tariff ruling: The U.S. Department of Commerce is set to rule on tariffs that could be placed on Bombardier's C-series passenger jet.

Boeing launched a trade complaint against Bombardier earlier this year, accusing its Canadian rival of selling the C Series airliner at "absurdly low prices."

Bombardier denies that it has engaged in unfair trade practices.

4. Global market overview: European markets opened mostly higher, while Asian markets ended mixed. Stocks in South Korea and Japan were lower, while China's markets posted gains.

U.S. crude futures jumped 0.6% to trade at $57.60.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Companies and economics: Carnival (CCL) and Darden Restaurants (DRI) will release earnings before the U.S. open, and FedEx (FDX) will follow after the close.

Pfizer (PFE) shares were higher premarket after the company announced a $10 billion stock buyback on Monday.

Shareholders in the London Stock Exchange will vote on the future of embattled chairman Donald Brydon. The hedge fund TCI Fund Management, which owns just over 5% of the LSE, has sought to oust Brydon.

The U.S. Census Bureau will publish its housing report for November at 8:30 a.m. ET.

Germany's Ifo Institute has released its latest business climate survey. It said the mood among German business leaders is "excellent, but not quite as euphoric as last month."

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Tuesday -- Fedex, Darden (DRI) and Carnival (CCL) report earnings

Wednesday -- General Mills earnings

Thursday -- Nike earnings; Final estimate on 3Q U.S. GDP

Friday -- El Gordo lottery in Spain