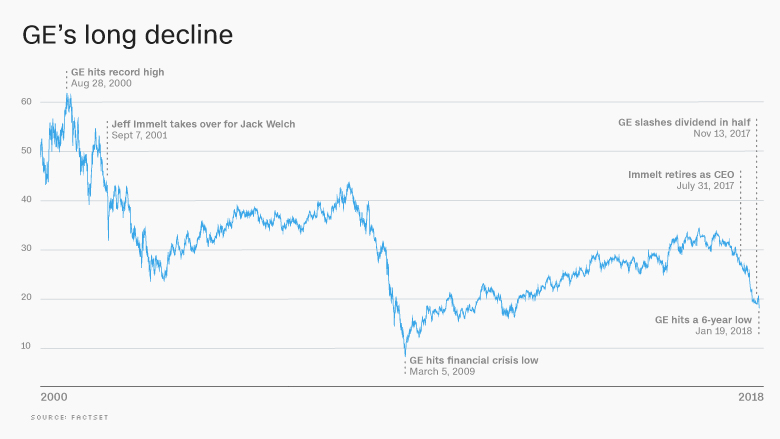

Wall Street is nervous that another shoe is about to drop at General Electric.

For decades, investors gave the company the benefit of the doubt. But years of unpleasant surprises have left them wondering what other problems might be lurking inside GE's finances.

In just the past few months, GE has halved its coveted dividend, disclosed a massive insurance loss, revealed 12,000 layoffs in its power division and signaled it could break itself apart. That's not counting the fiasco over the spare plane that escorted former boss Jeff Immelt around the world.

Fear of the unknown has caused GE shares to tank to a six-year low ahead of Wednesday's earnings report. GE (GE) sank 13% just last week, its worst since the Great Recession.

"The company is a big black box. What else is ticking under the hood?" said Deutsche Bank analyst John Inch.

UBS analyst Steven Winoker warned that there are unknown problems "still lurking in (or off) GE's balance sheet," especially in its lending unit. His best guess is that they could cost between $4 billion and $6 billion.

"When will the bad news end?" Winoker asked in a report on Tuesday.

Related: GE missed the stock market boom -- by a mile

GE declined to comment. CEO John Flannery promised last week to "move with purpose to reshape GE."

The company's trust with Wall Street has been eroded by decades of acquisitions gone bad, murky accounting and needless complexity.

"GE has taken countless credibility hits," Winoker wrote, from "ill-timed M&A" to badly missing financial targets.

Flannery, who inherited a mess when he took over last year for Immelt, has vowed to bring transparency and simplicity to GE. He'll face tough questions on Wednesday from analysts mystified about how it could miss the stock market boom so badly.

GE spooked shareholders again last week when it disclosed a larger than feared $6.2 billion hit from insurance problems at GE Capital, the lending unit that nearly destroyed the company during the financial crisis.

GE sold much of GE Capital, but what's left still poses risks.

For instance, GE Capital's discontinued subprime mortgage business, known as WMC, is still under a cloud of legal scrutiny. The Justice Department is investigating WMC's pre-crisis sale of subprime loans and GE is cooperating, the company has said in filings. Deutsche Bank, Bank of New York Mellon and others have also sued WMC, which GE sold at the end of 2007 during the subprime crisis.

Related: GE's $31 billion pension nightmare

Another problem for GE is its power division, which makes giant turbines and generators used by coal and natural gas plants. GE doubled down on fossil fuels in 2015 by paying $9.5 billion to purchase Alstom's power business, which makes coal-fueled turbines.

But the rise of renewable energy has crushed GE Power, forcing the division to announce plans last year to slash $1 billion in costs, in part by cutting 12,000 jobs. GE may eventually be forced to write down the value of the Alstom deal, the company's largest-ever industrial acquisition.

GE also has a $31 billion pension shortfall, easily the worst in the S&P 500. The pension deficit will be a long-term drag on GE's cash.

Deutsche Bank's Inch believes GE could "stabilize" itself if it raised cash by selling stock -- something the company hasn't done since the 2008 financial crisis. GE has said it has "absolutely no plans" to sell stock, which would dilute the portfolios of existing GE shareholders.

It's possible that Wall Street is treating GE too harshly, considering how far the stock has fallen. Just 32% of analysts have a "buy" rating on the stock, according to FactSet. GE's results on Wednesday may offer enough hope to turn some of those skeptics into believers. GE stock rebounded 4% on Tuesday.

The "bear case appears largely baked into the stock," Scott Davis, lead analyst at Melius Research, wrote in a Tuesday report titled "Getting Out of the Abyss."

But it's difficult to say all the bad stuff is priced in when there are so many questions about GE's balance sheet.

"People think something is buried there," said Alicia Levine, head of global investment strategy at BNY Mellon.