1. Trump's new tariffs: President Trump just made it more expensive to import solar panels and some washing machines into the United States. The Trump administration on Monday announced new tariffs of 30% on solar panels and taxes on large residential washing machines starting from 20% and going up to 50%.

"The President's action makes clear again that the Trump Administration will always defend American workers, farmers, ranchers, and businesses," U.S. Trade Representative Robert Lighthizer said in a statement.

China, the world's biggest supplier of solar panels, slammed what it described as "an abuse" of trade rules. The move "aggravates the global trade environment," China's Ministry of Commerce said.

South Korea, whose electronics companies LG (LPL) and Samsung (SSNLF) are among the top suppliers of washing machines to the U.S., said it would file a complaint with the World Trade Organization.

LG Electronics saw its stock price plunge as much as 5% Tuesday morning in Asia, before recovering later in the day. Samsung remained largely unaffected, gaining almost 2% during the Asia day.

Whirlpool (WHR), meanwhile, will be one stock to watch when markets open on Tuesday. The U.S. company, which filed a petition in 2011 alleging dumping by the Korean firms, stands to gain from the new tariffs.

2. NAFTA negotiations: The tariffs come as the Trump administration prepares for another big trade negotiation. Officials from the U.S., Canada and Mexico will meet in Montreal on Tuesday for a sixth round of talks on NAFTA.

The previous five rounds have seen little progress on reworking the 24-year old free trade agreement, and Trump has repeatedly threatened to pull out of it altogether if he doesn't get the deal he wants.

Top of his wish list? Cars. Trump wants to change how and where automobiles are made in North America, giving more work to U.S. manufacturers, but his proposals have been described by Mexican and Canadian officials as "unacceptable" and "extreme."

With seven rounds of talks scheduled in total, and key elections taking place in Mexico and the U.S. this year, time is running out.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Fox-Sky hurdle: A U.K. regulator on Tuesday recommended that the country's government block the proposed takeover of Sky (SKYAY) by 21st Century Fox (FOX).

The deal would likely be "against the public interest," the Competition and Markets Authority said, because it would give 21st Century Fox chairman Rupert Murdoch too much control over British media.

The authority proposed some changes to the deal to mitigate those concerns, which include spinning off Sky News.

Sky shares rose more than 2% in London Tuesday morning.

4. Netflix is red hot: Netflix stock is expected to open nearly 9% higher on Tuesday, according to FactSet, a day after the company said it added a record 8 million subscribers in the last quarter of 2017.

The growth in subscribers came despite a recent price hike, and the resulting stock surge could see its market capitalization top $100 billion for the first time.

5. Davos kicks off: The gathering of the global political and business elite begins Tuesday, with a big speech from India's Prime Minister Narendra Modi.

President Trump is scheduled to arrive at the Swiss mountain resort later in the week. The U.S. president's attendance at the World Economic Forum annual meeting had been in doubt because of the government shutdown.

Download CNN MoneyStream for up-to-the-minute market data and news

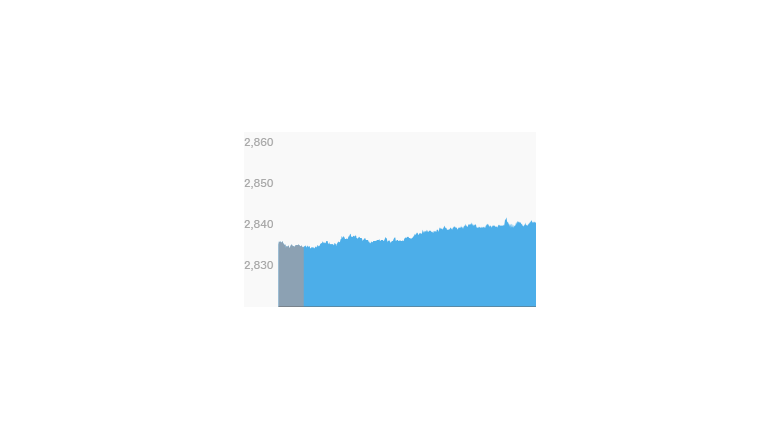

6. More market highs: The Dow Jones industrial average continued its push into uncharted territory, jumping 143 points to another record high after the U.S. Senate reached a deal to end the three-day government shutdown. The Nasdaq also hit an all-time high on Monday, gaining 1%, while the S&P 500 was up 0.8%.

U.S. stock futures edged upwards, while European markets are up in early trading and Asian markets ended Tuesday significantly higher.

Johnson & Johnson (JNJ), Kimberly-Clark (KMB), Procter & Gamble (PG) and Verizon (VZ) plan to release earnings before the open Tuesday, while Texas Instruments (TXN) and United Continental (UAL) are set to release earnings after the close.

7. Coming this week:

Tuesday -- Procter & Gamble, Verizon, United, Johnson & Johnson earnings; Davos starts; NAFTA talks resume.

Wednesday -- Comcast, Ford, GE earnings.

Thursday -- American Airlines, JetBlue, Southwest, Caterpillar, Intel, Starbucks earnings.

Friday -- Honeywell earnings, Q4 GDP.