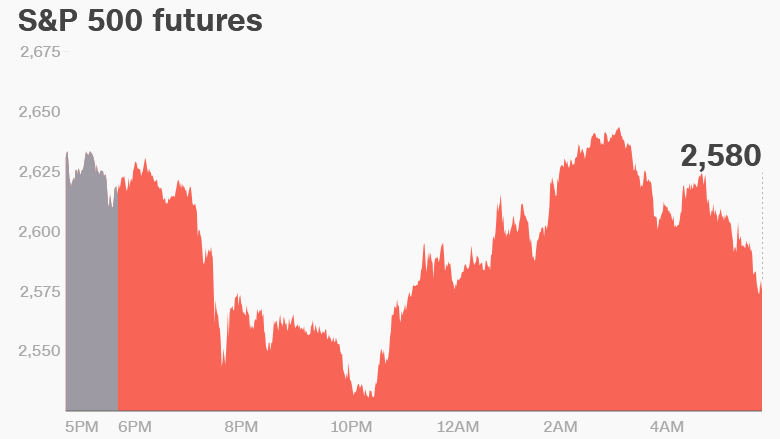

1. Volatile futures: U.S. stock futures have suffered wild swings ahead of the open on Tuesday.

Investors, brace for more volatility.

Dow futures were down 100 points -- 0.3% -- at 7:25 a.m. ET. They had dropped over 800 points overnight before rebounding into positive territory in the early morning hours.

S&P 500 and Nasdaq futures also swung between gains and losses.

The Dow ended Monday with a drop of 4.6%, or 1,175 points. At one point during the trading day the Dow had fallen by nearly 1,600 points. The S&P 500 shed 4.1% and the Nasdaq fell 3.8%.

The shock decline was nowhere close to the scale of destruction seen on Black Monday in 1987 or the financial crisis of 2008. But for investors lulled to sleep by the steady upward climb since Election Day in 2016, it was alarming.

"This is a rather abrupt reminder of what volatility looks like. Nothing has changed in economic terms," said Paul Donovan, global chief economist at UBS Wealth Management.

The CNNMoney Fear & Greed index has swung into the "extreme fear" zone.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Panic abroad: Europe and Asia followed the lead of U.S. markets on Tuesday, posting major losses. The Hang Seng in Hong Kong dropped 5.1% and Japan's Nikkei shed 4.7%.

Most European markets were 2% lower in early afternoon trade.

3. Lulu under pressure: Laurent Potdevin, the chief executive of Canadian yoga retailer Lululemon (LULU), is out after the company said he "fell short" of its standards of conduct.

"Lululemon expects all employees to exemplify the highest levels of integrity and respect for one another, and Mr. Potdevin fell short of these standards of conduct," the company said in a release Monday afternoon.

The company didn't say how Potdevin, who has been CEO since 2014, fell short of its standards.

Shares in Lululemon were set to decline at the open.

4. Media earnings: Several big media companies report earnings this week: Disney (DIS) on Tuesday, 21st Century Fox (FOXA) on Wednesday and News Corp (NWS) and Viacom (VIA) on Thursday.

Disney, which has announced plans to buy a major chunk of 21st Century Fox, may report a boost from "Star Wars: The Last Jedi," which has raked in more than $1 billion globally.

5. More earnings: Dunkin' Brands (DNKN), General Motors (GM), S&P Global (SPGI) and Spirit Airlines (SAVE) are releasing earnings before the open.

Chipotle Mexican Grill (CMG), Match Group (MTCH) and Snap (SNAP) will follow after the close.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Tuesday -- Earnings from Disney (DIS), Snap (SNAP), General Motors (GM), Dunkin' Brands (DNKN) and Chipotle (CMG)

Wednesday -- Earnings from 21st Century Fox (FOXA), Hasbro (HAS) and Tesla (TSLA)

Thursday -- Earnings from News Corp (NWS), Viacom (VIA), Twitter (TWTR), Kellogg (K), Thomson Reuters (TRI), Tyson Foods (TSN), Expedia (EXPE) and Yum! Brands (YUM)

Friday -- PyeongChang 2018 Winter Olympics begins; Apple's HomePod goes on sale