1. Two major events: Investors have two significant geopolitical moves to consider on Friday. Both involve President Donald Trump.

Trump has followed through on his promise to impose a 25% tariff on steel imports and a 10% tariff on aluminum imports. Canada and Mexico are exempt from the new tariffs, and other countries may also be granted a reprieve.

Top US trading partners including South Korea, China and the European Union have blasted the move.

Investors will be watching for what comes next. Retaliatory moves could spark a trade war that would slow trade and damage the global economy.

The White House also announced on Thursday that Trump had agreed to meet with North Korean leader Kim Jong Un, setting the scene for an unprecedented encounter between the two nations.

Asian markets powered higher on Friday, with some indexes posting gains of more than 1%. European markets were mixed.

It's generally been a positive week for markets. The Dow Jones industrial average, S&P 500 and Nasdaq have continued to recover from their sharp drop in early February.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. February jobs report: The US economy gained a surprisingly strong 313,000 jobs in February, according to Labor Department figures published Friday.

Unemployment stayed at 4.1%, the lowest in 17 years. Wages grew 2.6% in February compared with a year earlier.

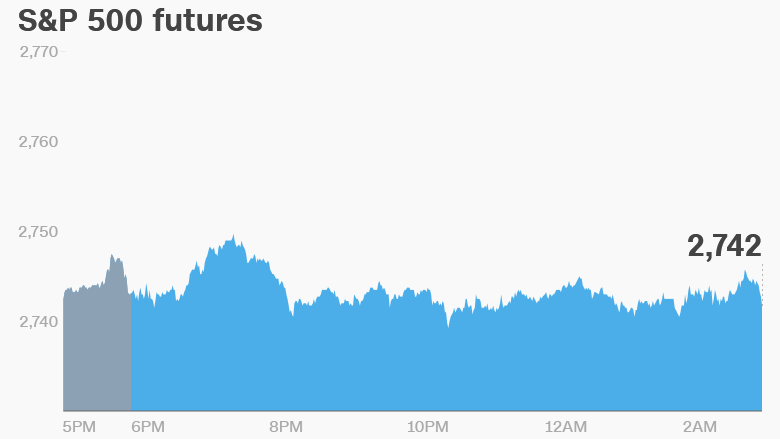

US stock futures spiked after the announcement.

Economists had estimated that 200,000 jobs would be added during the month.

3. Earnings: It's a quiet day for corporate earnings.

Big Lots (BIG) and Party City (PRTY) will report quarterly results before the open.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

4. Coming this week:

Friday — US monthly jobs report