1. Trade war fears: Investors are running scared after the United States and China fired the opening salvos of what could become a trade war.

President Donald Trump has directed the US trade representative to level tariffs on $50 billion worth of Chinese imports following an investigation into intellectual property theft.

The United States also plans to impose new investment restrictions and take action against China at the World Trade Organization.

China quickly responded with tariffs of its own that will hit US imports worth $3 billion. Beijing said the proposed trade sanctions would target US-made products ranging from pork to steel pipes.

The response from China was measured, but more retaliatory actions could be in the works.

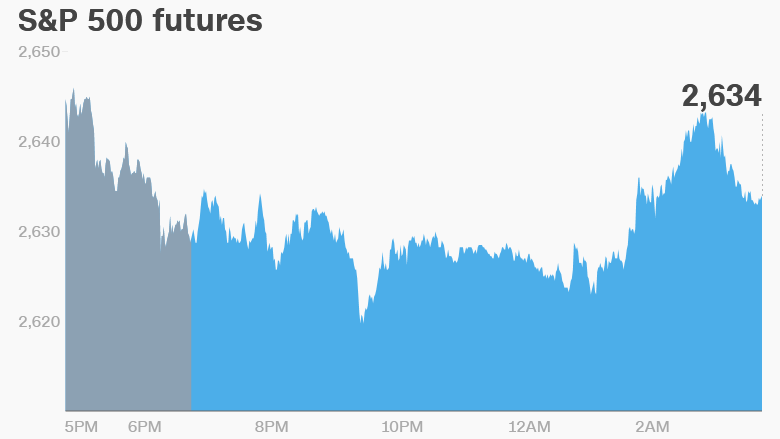

US stock futures were in negative territory.

European stocks were down over 1% in early trade. Japan's Nikkei shed 4.5%, while the Shanghai Composite dropped 3.4% and Hong Kong's Hang Seng declined 2.5%.

Gold and the Swiss franc, seen as safe havens by investors, both strengthened. The CNNMoney Fear & Greed Index shows that "extreme fear" is driving the markets.

2. Metal tariffs: The United States has granted temporary exemptions on steel and aluminum tariffs to the European Union, Argentina, Brazil, South Korea and Australia.

Exemptions for Canada and Mexico were previously announced.

The tariffs take effect Friday, but the exemptions mean they won't apply to many of the world's top steel producers. Lobbying efforts are now underway to make the exemptions permanent.

"I'm pleased that they've announced a temporary exemption for the EU," British Prime Minister Theresa May said in Brussels. "What I'll be working with my fellow EU leaders today on is to see how we can secure a permanent exemption for the EU."

May has a full agenda on Friday: European leaders are expected to formally adopt the agree the terms of the Brexit transition period and future trade deal negotiations between the United Kingdom and the European Union.

3. Thursday market recap: The Dow Jones industrial average dropped 2.9% after the Trump announcement on China. The S&P 500 declined 2.5% and the Nasdaq shed 2.4%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Earnings and economics: The US Senate passed a $1.3 trillion spending bill early on Friday, averting a potential government shutdown.

The massive spending package marks the end of a months-long funding stalemate in which lawmakers were forced to pass one short-term spending bill after another to stave off a shutdown.

The US Census Bureau is set to release its new home sales report for February at 10 a.m. ET.

Russia's central bank will announce a rate decision.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

5. Coming this week:

Friday — New Home Sales