1. Tesla CEO speaks: Elon Musk has given an emotional interview to the New York Times that addresses his controversial tweet about taking Tesla private.

"This past year has been the most difficult and painful year of my career," he told the newspaper. "It was excruciating."

Musk told The Times that no one else saw the tweet before he posted it while en route from his house to the airport. He said he doesn't regret sending it and has no plans to leave Twitter (TWTR).

Asked if his notoriously heavy workload was physically affecting him, he told The Times: "It's not been great, actually. I've had friends come by who are really concerned."

The Wall Street Journal reported Thursday that the US Securities and Exchange Commission began investigating last year whether Tesla misled investors about its Model 3 car production.

Shares in Tesla (TSLA) were down slightly ahead of the open.

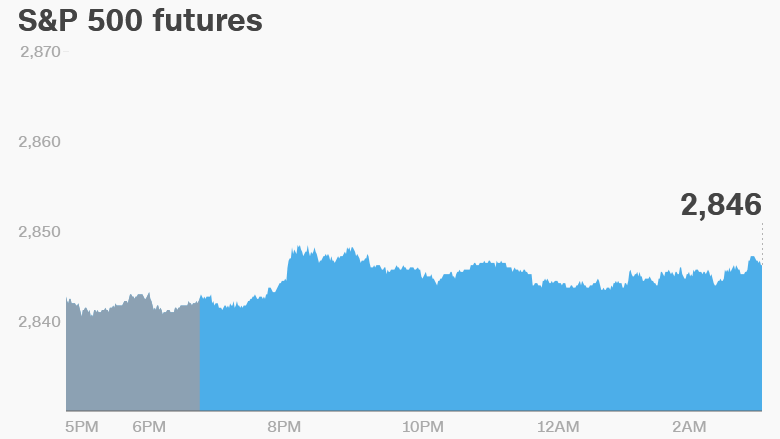

2. Market overview: US stock futures were little changed and European markets were calm in early trading.

Asian markets ended with mixed results. The Shanghai Composite dropped 1.3%, while most other major indexes closed with small gains.

The Dow Jones industrial average shot up 1.6% on Thursday, its best showing in four months. The S&P 500 added 0.8% and the Nasdaq gained 0.4%.

3. Tractors and tariffs: Deere (DE) reports earnings before the open.

The farming and construction equipment company had a disappointing second quarter because of the increased cost of materials.

It could face another rough quarter because of the Trump administration's tariffs.

Some countries have placed high tariffs on US agricultural goods in response to America's steel and aluminum taxes, and an escalating trade fight with China is particularly hurting American soy bean farmers.

That could cause farmers to delay purchases of new equipment.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. US market movers -- Nordstrom, Nvidia: Shares in Nordstrom (JWN) were set to surge 9% after the company released well-received earnings on Thursday after the close.

Shares in Nvidia (NVDA) were down 5% in extended trading as investors reacted to the firm's quarterly results.

5. International developments: Shares in Air France-KLM (AFLYY) dropped 3% after the company said it had hired Air Canada executive Benjamin Smith as CEO. The carrier has been operating without a CEO since May.

The Turkish lira was holding steady after another public attack on the country from President Donald Trump on Twitter (TWTR).

Currency traders have been selling the lira over concerns about Turkey's economy and central bank independence. Heightened tensions with the United States over Turkey's detention of an American pastor have further damaged investor confidence.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Friday — Deere (DE) earnings, University of Michigan releases American consumer sentiment index for August