1. Central bankers meet: Federal Reserve chairman Jerome Powell is scheduled to speak at the Economic Policy Symposium in Jackson Hole on Friday.

The speech comes less than a week after President Donald Trump took a swipe at Powell.

In an interview with Reuters, Trump said he was "not thrilled" with the Fed chairman for raising interest rates, arguing the central bank should do more to help the US economy.

Powell was hand-picked by Trump to lead the central bank.

2. Tech summit: Representatives from top US tech companies are expected to meet on Friday in San Francisco to discuss security issues ahead of the 2018 US elections.

According to BuzzFeed, Facebook's (FB) head of cybersecurity policy, Nathaniel Gleicher, invited representatives from companies including Google (GOOGL) and Microsoft (MSFT).

A study published in the American Journal of Public Health on Thursday suggests Russia's online meddling went beyond the 2016 US presidential election and into public health, amplifying online debates about vaccines.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Big day for Samsung: Samsung's (SSNLF) Galaxy Note 9 goes on sale Friday around the world.

The Note 9 offers the same look and feel as other Note devices, but the screen is slightly bigger than its predecessor. Like other Galaxy phones, the Note 9 is water resistant, and features an infinity display and wireless charging.

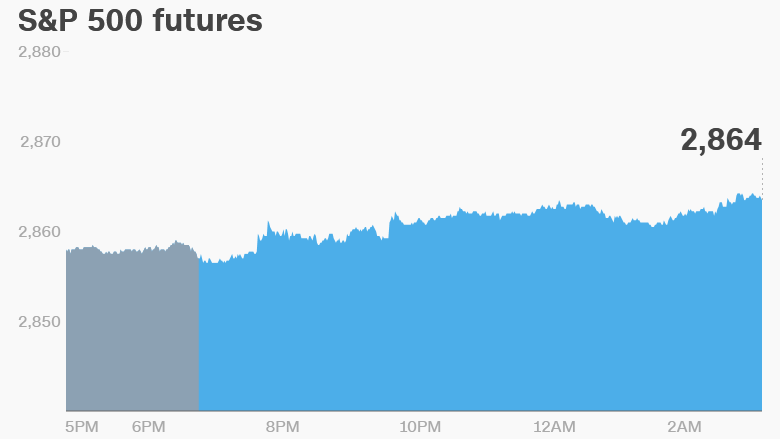

4. Global market overview: US stock futures were modestly higher.

European markets posted small gains in early trade. Asian markets ended mixed.

Australia's benchmark index was little changed after Malcolm Turnbull was ousted as prime minister. Scott Morrison, one of the architects of Australia's tough immigration policy, looks set to become the country's sixth prime minister in just over a decade.

The Australian dollar strengthened 0.5%.

On the economic front, the German economy grew 0.5% in the second quarter compared to the previous three months.

Rainer Sartoris, an economist at HSBC, warned that while growth was strong, trade tensions pose a risk for the second half of the year.

5. Stock market movers: Shares in Autodesk (ADSK) were up 8% premarket as investors reacted to better-than-expected earnings.

Shares in Gap (GPS) and Ross Stores (ROST) slipped in extended trading as investors expressed disappointment with the firms' latest results.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Friday — Foot Locker (FL)earnings