1. Tech vs. President Trump: Shares in Google dropped nearly 1% on Tuesday after President Donald Trump accused the search company of bias.

It's the latest indication that the tech industry is struggling to avoid being dragged into partisan fights in the United States, where the internet and social networks play a vital role in campaign politics.

Google defended itself, saying in a statement that "search is not used to set a political agenda and we don't bias our results toward any political ideology."

Later in the day, Trump accused Google (GOOGL) of "taking advantage of a lot of people." The president, grouping Google with Facebook (FB) and Twitter (TWTR), said tech companies are "treading on very, very troubled territory and they have to be careful."

Facebook may also be facing some internal discord: The New York Times reports that over 100 employees have joined an online group that aims to diversify the company's "political monoculture."

2. Musk on Twitter: Investors in Tesla (TSLA) are keeping a close watch on Elon Musk's Twitter account again.

The Tesla CEO used the social media network on Tuesday to revive an unfounded accusation about a caver who helped rescue 12 boys and their soccer coach in Thailand.

Musk said it was "strange" that the caver had not sued him after Musk called him a "pedo," or pedophile, in a tweet in July. Musk had apologized for the tweet.

He also denied that he cried during an interview earlier this month with The New York Times.

Musk announced over the weekend that he was abandoning plans to take the carmaker private. Some analysts have encouraged him to take a break from Twitter and bring in a more disciplined deputy to look after daily operations.

Watch CNNMoney's 'Markets Now' at 12:45 p.m. ET

3. Aston Martin IPO: James Bond's favorite carmaker is planning to go public.

Aston Martin said Wednesday that it's aiming to list shares on the London Stock Exchange later this year, marking another milestone in the revival of the British brand.

The public offering would value the carmaker at over $6 billion, according to media reports. The company plans to float at least 25% of its shares on the stock market.

The carmaker sold over 5,000 cars in 2017, its best performance in nine years. That yielded record revenue of £876 million ($1.1 billion), an increase of nearly 50% over the previous year.

Results for the first half of the year published Wednesday show that momentum has continued.

Revenue in the first half was up 8% over the previous year, while profit increased 14%. The carmaker said it's on track to deliver as many as 6,400 cars this year.

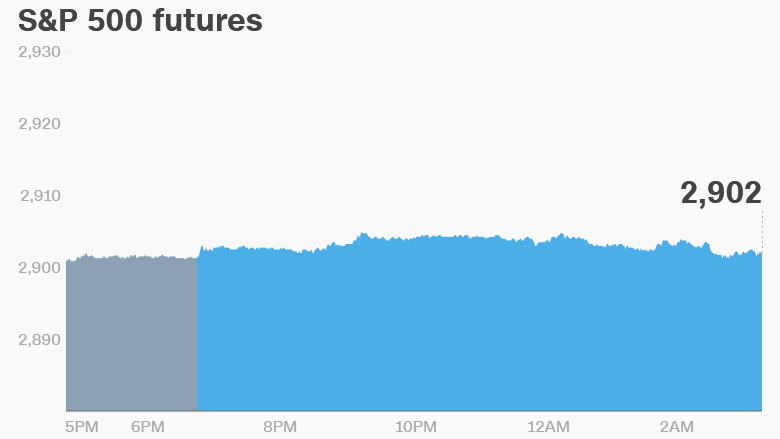

4. Global market overview: US stock futures were higher after another record-setting session Tuesday.

European markets posted small gains in early trade. Asian markets ended mixed.

The Dow Jones industrial average added 0.1% on Tuesday. The S&P 500 and the Nasdaq finished at record highs.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: Dick's Sporting Goods (DKS) and Express (EXPR) will release earnings before the open. Guess? (GES) and Salesforce (CRM) will follow after the close.

Jack Daniel's owner Brown-Forman (BFA) also reports. The company has warned that it could be hurt by new EU tariffs on bourbon and other alcoholic beverages.

A report on US crude inventories will be released at 10:30 a.m. ET.

The US government releases its second estimate for economic growth in the second quarter at 8:30 a.m. The first reading showed a 4.1% growth rate, the best in four years.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Wednesday — Salesforce (CRM) and Brown-Forman (BFA) earnings

Thursday — Abercrombie & Fitch (ANF), Campbell Soup (CPB), Lululemon (LULU) and Dollar Tree (DLTR) earnings

Friday — Eurozone unemployment data released for July