1. Big Tech in Senate: Big Tech executives are coming to Capitol Hill on Wednesday to testify about election meddling.

Facebook (FB) COO Sheryl Sandberg and Jack Dorsey, the CEO of Twitter (TWTR), will appear before the Senate Intelligence Committee to discuss actions their companies have taken to thwart foreign influence campaigns targeting the 2018 midterm elections.

The committee requested that a high-profile executive from Google, which owns YouTube, also appear to testify. Google (GOOGL) and its parent company Alphabet, however, declined to send one of their top people.

2. Emerging markets fears: Emerging markets currencies tumbled against the dollar on Wednesday, with the Mexican peso, South African rand, Indian rupee and Indonesian rupiah among the biggest losers.

Rising US interest rates, political clashes and the global trade war have in recent months exposed frailties in multiple emerging markets. Turkey and Argentina have been hardest hit, but investors are now worried about contagion.

Adding to fears, a Markit index that measures emerging markets manufacturing fell to a fresh 14-month low in August.

Watch CNNMoney's 'Markets Now' today at 12:45 p.m. ET

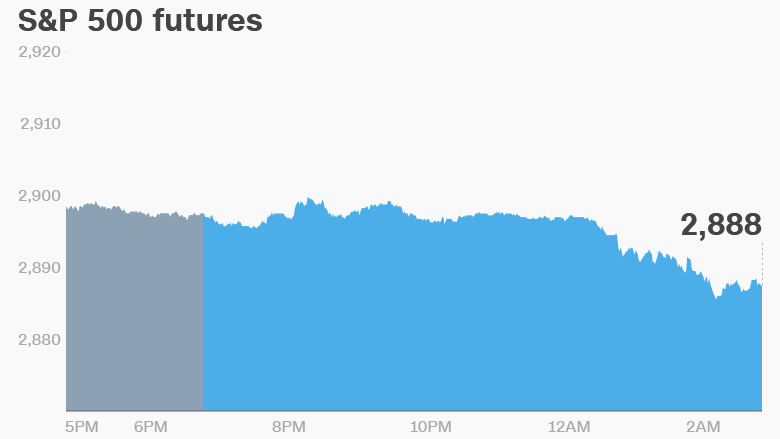

3. Global stocks overview: US stock futures were pointing lower.

European markets opened down, with exchanges in London, Frankfurt and Paris all dropping roughly 0.5%. Asian markets also suffered losses following disappointing Chinese service sector data.

The Dow Jones industrial average shed 0.1% on Tuesday, while the S&P 500 and Nasdaq dropped 0.2%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Stock market movers: Shares in JD.com (JD) declined 5% in premarket trading. Minnesota police said Tuesday that Richard Liu, the billionaire founder of the Chinese tech company, was arrested last week following a rape allegation.

Liu, who denies any wrongdoing, was released Saturday without charge and without having to post bail. He has since returned to China.

5. Earnings and economics: Duluth Trading Co (DLTH) and Vera Bradley (VRA) will release earnings before the open. DocuSign (DOCU) will follow after the close.

Amazon's (AMZN) total market value passed $1 trillion on Tuesday. The company became the second to pass that milestone, following Apple's ascent into 13-digit territory at the beginning of August.

Amazon and Apple (AAPL) now make up more than 8% of the entire value of the S&P 500, according to Howard Silverblatt, senior index analyst for S&P.

Theranos, the Silicon Valley startup whose founder faces fraud charges, is preparing to wind down its business. The Wall Street Journal reports that Theranos CEO David Taylor emailed shareholders to announce the blood-testing company will dissolve.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Wednesday — DocuSign (DOCU) and Vera Bradley (VRA) earnings; Twitter and Facebook executives testify before the Senate Intelligence Committee

Thursday — Barnes & Noble (BKS), Broadcom (AVGO) and GameStop (GME) earnings; NFL regular season begins

Friday — Jobs report