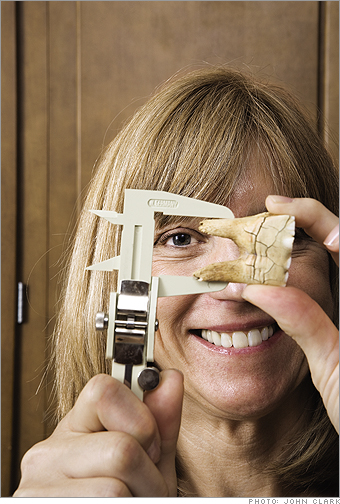

That included lots of travel, plus falling in love and remarrying (she has two grown children from a previous marriage). Last year she and husband Michael, 40, the former owner of a personal training studio, moved to Portland; he hopes to open another studio there. Skogg began taking archaeology and anthropology classes at a local community college. Her dream now is to earn a spot on a prestigious dig in Egypt with Michael. She hopes the dig will help her lay the groundwork to find a job in archaeology, even if it's just at a museum.

The reality: Thanks to the money left from her payout, Skogg can easily afford an Egyptian dig: Costs for Michael and her will total about $20,000, including air fare and side trips. But important digs won't take just anyone. They'll both have to submit résumés.

Another consideration: If Skogg winds up in a museum job afterward, she'll make very little money - at the same time that Michael will be trying to launch a small business.

The Plan:

- Highlight your skills. Skogg's archaeology classes will be helpful in getting her a spot on, say, a major dig among temple ruins in Luxor, says Rita Zawaideh, a travel agent in Seattle. She should also retool her résumé to focus on other skills she can contribute, such as setting up budgets or helping raise funds. Because Michael lacks that kind of experience, it will be harder for him to qualify - so she should consider going alone.

- Plan early. Skogg will need six to nine months to apply for a spot, win acceptance and get security clearance.

- Go back to work. Skogg isn't sure if she wants another job, but her nest egg will support annual spending of just $70,000 - much less than the $150,000 she and Michael go through today. So the couple will have to earn some money, says Ellen R. Siegel, a financial planner in Miami. Assuming Michael's business is successful (and doesn't require investment on Skogg's part), they should do fine even if she brings home a modest museum salary.