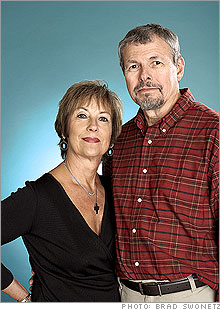

Mary and Martin Pearsall have lived frugally, saved regularly and invested wisely in their 30 years of marriage. They've also managed to avoid the kind of crippling debt that can spoil the best-laid retirement plans. They steered clear of credit cards by living within their means, and they've dutifully paid the mortgage on their $250,000 Colorado Springs house. They now owe just $64,000.

"We've been careful without being draconian," Martin says. "We would never accumulate debt we couldn't handle."

Martin worked as an Episcopal priest until last year, and Mary has been a personal trainer and a business consultant. Now, with the help of a sizable inheritance from Martin's mother, they have a portfolio worth over $1 million. With no major debt to hold them back, the Pearsalls plan to scale back their work lives soon and travel, as they've been hoping to do for ages.

"I want to be disencumbered from having to be somewhere," says Mary.

For most people, during a time of economic growth and soaring markets, it's easy to believe that income will keep rising faster than debt payments. But in retirement you can no longer count on that unlimited potential for better pay. If you don't cut your debt load while you're still working, says Marilyn Dimitroff, a financial adviser in Bloomfield Hills, Mich., you will face the worst possible scenario: a retirement saddled with mounting debt and only a limited income to repay it.