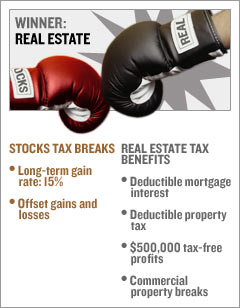

Real estate, by contrast, delivers a battery of tax benefits, especially for your home, says Ronald Hegt, a senior tax partner at Hays & Co., a New York City C.P.A. firm. You can deduct mortgage interest and property taxes yearly. And when you sell your house, the first $500,000 in profits are tax-free (for individuals, the first $250,000). You are on the hook for long-term capital gains taxes for any extra profit, but the top federal rate is only 15%.

Rental and commercial property also come with breaks. Expenses to maintain the property are deductible. And you can write off depreciation, a break for the supposed wear and tear on the property. On the flip side, there's no exclusion from taxes when you sell, and you pay 15% in capital-gains taxes on any profit. Worse, the government makes you pay taxes on the depreciation you took.