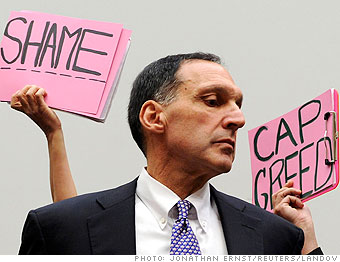

Dick Fuld takes his seat prior to testifying before a congressional hearing on the cause and effects of the Lehman Brothers bankruptcy.

Thain will continue to oversee the Merrill Lynch businesses at Bank of America and report directly to Lewis. He will no doubt have a large role in helping to eliminate 35,000 jobs -- as has been announced -- at his new firm.

Geithner seems to have passed his six-month trial by fire and is awaiting his confirmation hearing to become Secretary of the Treasury in the Obama administration.

When Fed chief Ben Bernanke and Paulson have discussed their decision to let Lehman fail, neither one has expressed any doubts about the wisdom of their decision.

On Monday morning, September 15, as the Lehman volcano was spewing molten financial lava to every corner of the globe, a pale and tired-looking Paulson said at a White House press conference that he "never once considered that it was appropriate putting taxpayer money on the line in resolving Lehman Brothers." He added, "Moral hazard is not something I take lightly."

More galleries

Last updated December 16 2008: 4:23 PM ET