Investments in the bargain bin

Once-in-a-generation sales have sprung up in this crazed market.

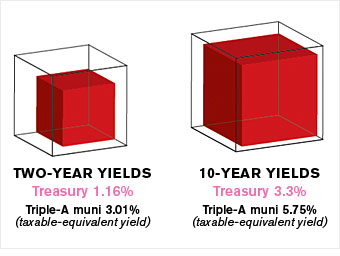

With taxes likely to rise, you'd expect demand for bonds issued by city, county and state governments to grow -- thanks to their tax-exempt status. Think again. Things have gotten so out of whack in this credit crisis that 10-year triple-A munis are yielding 4.14%. Assuming you're in the 28% bracket, that's like getting 5.75% on a Treasury. Yet 10-year Treasuries are yielding only 3.33%. True, munis can default. But even in a recession, the threat is not nearly enough to justify this differential, experts say. Go with a diversified Money 70 fund like Vanguard Intermediate Term Tax-Exempt (VWITX).

NEXT: Eaton

Last updated December 23 2008: 10:46 AM ET

Data for all charts as of Nov. 24. Muni bond figures are taxable-equivalent yields assuming a 28% income tax rate. SOURCES: Bloomberg, Morningstar, Municipal Market Advisers.