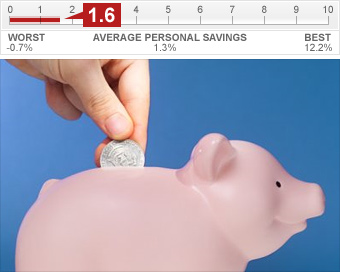

In September, Americans saved an average of 1% of their personal income, down from 1.9% the month before. In fact, the personal savings rate has been on a steady decline since May, when it was at five percent - an unusually high level for Americans, possibly caused by the government's distribution of stimulus checks. Overall, the personal savings rate in the third quarter of 2008 was 1.3%.

The personal savings rate goes down, or can even become negative, when you borrow money to pay personal bills - because you are incurring more debt relative to your income. Personal savings was negative in the third quarter of 2005, when the rate went down to -0.7%. That's the lowest it's been in the last 28 years.

On the other end of our scale, people were banking the biggest chunks of their income in 1981, 12.2%.

So, if we make -0.7% equal to zero and 12.2% equal to 10, personal savings in the third quarter of 2008 scores a...

Personal Savings: 1.6

NEXT: Industrial Production