The most important reason you need to own foreign stocks has nothing to do with the fact that they've trounced U.S. equities for the past five years. Sticking only with domestic stocks is akin to shopping in a store that's missing most of its inventory: Nearly 60% of the world's stock market value resides in companies outside our borders.

Besides, since investing in stocks is all about owning a piece of a growing economic pie, you have to go to where the growth is - and 76% of the world's economic activity takes place outside the U.S.

Then there's the diversification argument. Even though foreign markets held up no better than U.S. ones in the current downturn, overseas diversification still works. Researchers at T. Rowe Price found that since 1970, a 20% weighting in foreign equities both raised a U.S. fund portfolio's return and cut its risk.

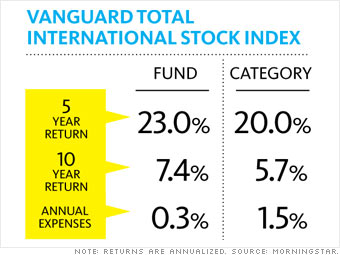

The simplest way to add stocks from both developed and emerging economies to your portfolio is to own Vanguard Total International Stock Index. As an index fund, it merely aims to match the return of the world's stock markets. Thanks to the inherent wisdom and efficiency of this approach - the fund charges a tiny 0.27% a year in expenses - it has outperformed more than 90% of its peers over the past five years.

Alternatives: Vanguard FTSE All World Ex-U.S. ETF (VEU) and Dodge & Cox Intl. Stock (DODFX )

NEXT: A small-company fund