G-20 summit: 6 countries in recovery

The G-20's six largest economies took a big hit during the global recession in the past year and a half. Challenges remain but most appear on the path to recovery.

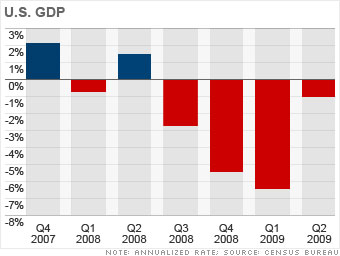

GDP: -1%

Inflation: -1.5%

Unemployment: 9.7%

Markets: 18.3%

Interest rate: 0% to 0.25%

The U.S. economy appears to be stabilizing after declining for four straight quarters, but the recovery has been tepid so far.

Financial markets have shown signs of improvement, and interbank lending has largely returned to normal. Consumer spending is still shrinking due to ongoing job losses and difficult credit conditions, but it has been stabilizing over the past quarters. Furthermore, home sales and new home construction are beginning to make a long-awaited comeback.

Businesses have continued to cut back on spending and have sharply reduced their inventories. But many economists believe that companies are largely done with their cuts, which could lay the groundwork for economic growth this quarter. The massive $787.2 billion stimulus bill is also expected to give GDP a boost in the current quarter.

"The recession is very likely over at this point," Federal Reserve Chairman Ben Bernanke said last week. But he also added, "It's still going to feel like a very weak economy for some time."

That's because unemployment continues to rise, retail sales are still slipping, factories have cut output to the bare bones and wages remain depressed.

NEXT: Japan: Cautious improvement

Last updated September 24 2009: 11:03 AM ET

Source: IMF, national statistics offices, central banks, S&P 500