Jim Moffett

Scout International Fund

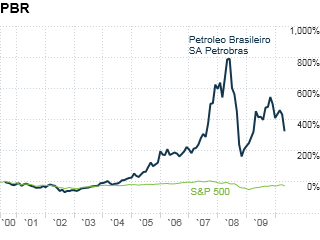

Two of Jim Moffett's current investing themes are Asian economic growth and shrinking oil output. He thinks Petrobras, the Brazilian oil giant, will benefit from both. (Manager of the $5.3 billion Scout International Fund, Moffett beat 91% of his peers over the past 10 years, with a 4.2% annual gain.)

Unlike competitors, which are facing declining reserves, he notes, "Petrobras is a growth company." It discovered massive offshore oilfields a few years ago. That news fueled a 181% spurt in the company's stock price, but it has since been cut in half; it is trading at just nine times earnings.

Moffett thinks Petrobras has the technical knowhow to exploit its find in the coming years. He also thinks oil prices will stay high. "When the worldwide economy turns around," he says, "energy demand will turn around."

--M.K.

NEXT: Microsoft