Who profits from foreclosure?

Businesses and property owners are leveraging bargain-basement housing prices, making money on properties that have plunged in value and have been repossessed.

Despite efforts to curtail foreclosures across the U.S., the nation is still in the midst of a foreclosure crisis. In 2010, foreclosure activity increased in 149 of the nation's 206 metropolitan areas with a population of 200,000 or more, according the foreclosure tracking company RealtyTrac. Last year, more than 2.8 million homes in the U.S. had foreclosure filings.

But one man's loss is another's gain. Foreclosed homes are often up for sale at bargain prices. Some businesses and property owners have used that to their advantage and are finding ways to turn a profit on properties that have depreciated in value and have been repossessed by banks.

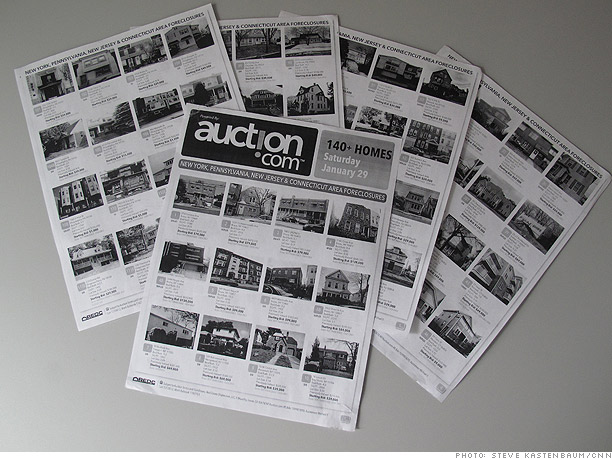

While real estate sections in newspapers across the country are filled with ads for homes that are being foreclosed on, many banks opt to sell properties on the auction block.

But one man's loss is another's gain. Foreclosed homes are often up for sale at bargain prices. Some businesses and property owners have used that to their advantage and are finding ways to turn a profit on properties that have depreciated in value and have been repossessed by banks.

While real estate sections in newspapers across the country are filled with ads for homes that are being foreclosed on, many banks opt to sell properties on the auction block.

NEXT: Some benefit from bargain prices

Last updated February 09 2011: 9:51 AM ET